partners for life

Payment Summary Changes under STP

As we’ve covered a few times over the past year, Single Touch Payroll (STP) is well and truly upon us. For employers with 20 or more employees as at 1 April 2018, STP must be implemented; while employers with 19 or fewer employees at 1 April 2018 can opt in at any time between now and their compulsory start date, which is 1 July 2019. Along with the new reporting obligations, employers must also remember that they are no longer obligated to provide their workers with year-end payment summaries under the new STP rules.

Recap – What is Single Touch Payroll?

Firms with 20 or more employees will be required to implement Single Touch Payroll or STP from 1 July 2018. STP is an Australian Taxation Office (ATO) initiative aimed at streamlining the way employers report their tax and superannuation information to the ATO.

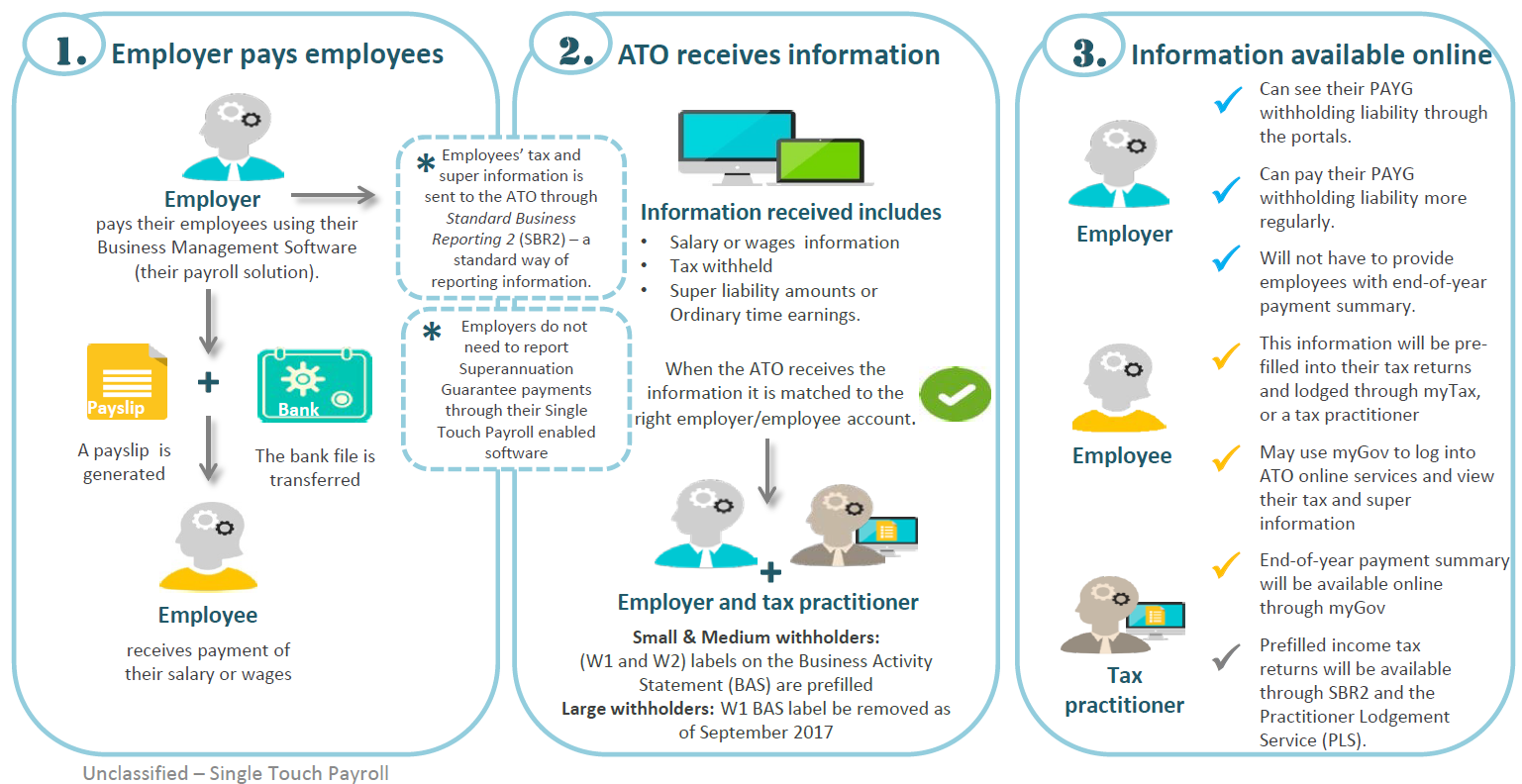

Below is the ATO’s overview of Single Touch Payroll:

Tax Banter (2018). https://taxbanter.com.au/banter-blog/single-touch-payroll/. [image].

Payment Summaries under STP

As the government looks to streamline reporting processes and ensure employer obligations are met, online services like MyGov are becoming more prevalent. With this in mind, the introduction of STP has brought with it a shift towards online income statements instead of traditional payment summaries. Whilst employers can choose to provide payment summaries for the first year of STP reporting, they are not required to do so.

What should employers do?

A significant consideration to be made at this time is whether or not your employees have access to their MyGov account. As more services move to the digital space, people need to be becoming more familiar with using the online portals and tools available. Accessing payment summaries for the first time is a good way to start this process and embrace the changes, and to ensure that your workers are able to get to the information they need.

How can McKinley Plowman help?

With our experience in taxation legislation, if you have any enquiries or concerns regarding the introduction of STP, we are on hand to help you out. Give us a call on 9301 2200 or go to www.mckinleyplowman.com.au.

REFERENCES

https://www.mybusiness.com.au/finance/4605-ato-flags-changes-to-payment-summary-under-stp

https://www.ato.gov.au/Business/Single-Touch-Payroll/

https://www.mckinleyplowman.com.au/community/reminder-single-touch-payroll-coming-soon/

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today