partners for life

REMINDER – Single Touch Payroll coming soon

Do you employ staff? If so, please read on – there are important changes to payroll processing and reporting just around the corner that may affect you and your business.

It’s hard to believe that January has already come and gone! Therefore it’s worth a refresher on Single Touch Payroll (STP) before the April 1st headcount deadline (and subsequent July 1st implementation date). Here’s a recap of our article from last August (https://www.mckinleyplowman.com.au/community/single-touch-payroll-means-employers/)

What is Single Touch Payroll (STP)?

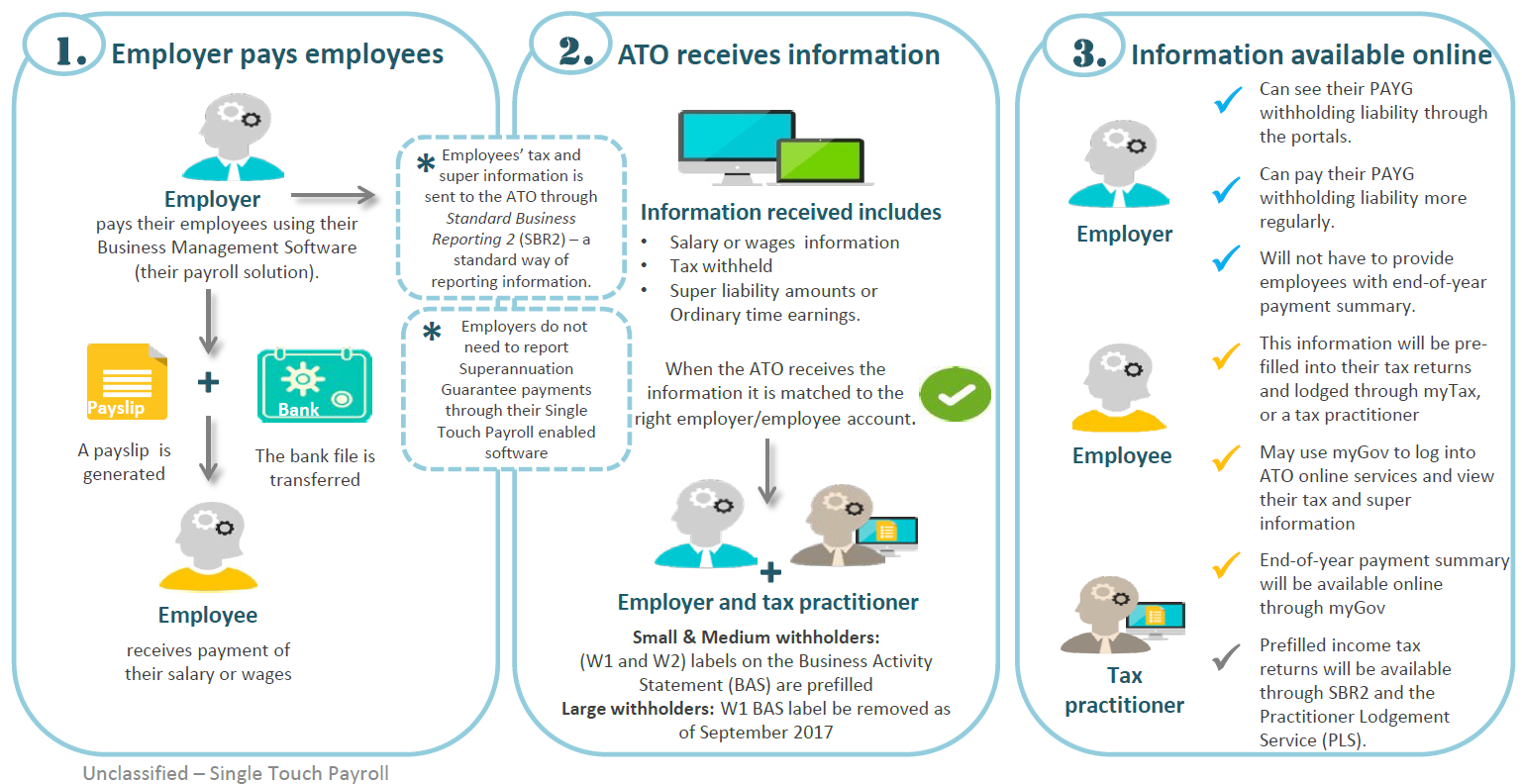

Firms with 20 or more employees will be required to implement Single Touch Payroll or STP from 1 July 2018. STP is an Australian Taxation Office (ATO) initiative aimed at streamlining the way employers report their tax and superannuation information to the ATO.

Below is the ATO’s overview of Single Touch Payroll:

REF 3

What should employers do?

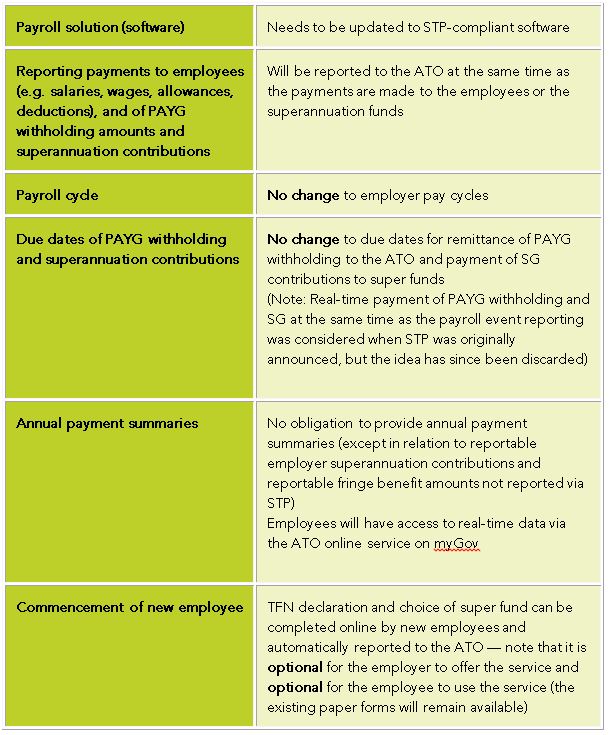

To identify whether reporting through STP is required, employers will need to do a head count of the number of employees within their business on the 1st April 2018. Those with 19 or less employees will have the option to report through STP.

REF 3

How can McKinley Plowman help?

With our experience in taxation legislation, if you have any enquiries or concerns regarding the introduction of STP, we are on hand to help you out. Give us a call on 9301 2200 or go to www.mckinleyplowman.com.au.

Resources

- http://taxandsupernewsroom.com.au/employer-clients-prepared-single-touch-payroll/

- https://www.ato.gov.au/about-ato/about-us/in-detail/strategic-direction/streamlined-reporting-with-single-touch-payroll/?anchor=Employers1#Employers1

- https://taxbanter.com.au/banter-blog/single-touch-payroll/

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today