partners for life

MP+ Update: A Comprehensive Summary of the Coronavirus Stimulus Packages So Far

Over the past few weeks, much has been announced about what the Australian Government will be bringing in to help mitigate the impact of Coronavirus (COVID-19) on the economy.

Keeping on top of everything that’s happening in the world at the moment is challenging, so we’ve put together this summary of the critical measures that have been announced, concerning both business owners and salary earners. You’ll also find links to helpful resources, as well as the support McKinley Plowman can provide through this challenging time. To keep up to date with our articles as they come through, be sure to check in periodically with the MP+ News Page.

Contents:

- JobKeeper Payments

- JobKeeper 2.0

- Bank Care Package

- Coronavirus SME Guarantee Scheme

- SME Loan Guarantee Scheme Extension & Expansion

- ATO Relief – PAYGW Refunds

- ATO Relief – Tax Payment Deferral Options

- Instant Asset Write-Offs and Accelerated Depreciation

- Superannuation & Social Security for Individuals & Sole Traders

- Income Support for Individuals & Sole Traders

- Apprentice Relief

- Payroll Tax (WA)

- Land Tax Deferral

- Staff Considerations

- Insolvency – Temporary Relief for Financially Distressed businesses

- Retail & Commercial Leases

- Key Practical Business Considerations

- COVID-19 Lending Guide

- WA COVID-19 Business and Industry Advice

- JobTrainer Scheme

1. JobKeeper Payments

The Australian Government has announced a third stimulus package, which is welcome relief for businesses and employees alike. The ‘Job Keeper’ Package will subsidise wages of $1,500 for each eligible employee (per fortnight) for a period of up to six months for all eligible businesses. In case you’ve missed out previous updates on the stimulus packages, feel free to check out the MP+ News Page, Facebook and LinkedIn.The scheme aims to subsidise employees’ wages in order to incentivise business owners to keep people employed and working where possible during the Coronavirus (COVID-19) pandemic. This subsidy applies to a large number of businesses and their employees, so let’s have a look at who is eligible for the payment, and what needs to be done to get it using our three step process.

eligible employers – information

For employers to be able to take advantage of the JobKeeper payment, there are a few eligibility criteria that have to be met.

-

- Business turnover must have reduced by the following amounts as a result of COVID 19:

Business Type Reduction %

Not-for-Profits 15%

Other businesses <= $1billion turnover 30%

Other businesses > $1billion turnover 50%

- Turnover reductions must be calculated based on a comparable calendar month from one year ago (e.g. April 2019 to April 2020). However, a quarterly comparison is available for the quarters ended 30 June and 30 September (if required).

- Please note that some businesses and specific employees are excluded from JobKeeper payments, subject to the disclaimers set out in the calculator below.

JobKeeper Calculator for Employers

As the JobKeeper payment has recently been legislated, business owners should now be assessing their eligibility and possible level of payments receivable.

Below is a link to a JobKeeper calculator, which should give you an idea of the JobKeeper payments that you may be entitled to.

Are you an employer? Click Here to Access our FREE JobKeeper Calculator

What if you do not satisfy the decline in turnover?

For businesses that do not satisfy the turnover test but have still been adversely impacted by COVID-19, there are now new guidelines set out by the ATO which detail how you may still be eligible for JobKeeper, providing you meet special circumstances, which include:

- Businesses that haven’t been trading for 12 months;

- Businesses that were in the process of scaling up;

- Businesses that have been through restructuring, acquisition or merger in the last 12 months; or

- Highly variable turnover or seasonal fluctuations

McKinley Plowman can assist you in assessing your turnover reductions to hep determine your eligibility; as well as evaluating the new alternative tests set out by the ATO, should they apply to your business.

Exceptions

- It is also worth noting that businesses which are subject to the major bank levy (e.g. certain banks / financial institutions) will be ineligible for the JobKeeper Payments.

- This is an ongoing test, so if the above conditions are not satisfied then please reassess on a monthly basis in case your circumstances / eligibility change.

- Please note that some businesses and specific employees are excluded from JobKeeper payments, subject to the disclaimers set out in our calculator (link above).

eligibility criteria as a business participant

It is important to remember that employees on wages are not the only people that can be eligible for JobKeeper. If you are a business participant who is not paid a normal wage; a sole trader; an adult beneficiary of a trust; a partner in a partnership; or a director/shareholder in a company, you may also be eligible to receive the payments. Below you’ll find some links to the ATO website which outline the eligibility criteria for these different roles; as well as the application form for eligible business participants.

Sole Traders and Other Entities

JobKeeper nomination notice for eligible business participants – excluding sole traders

business owners: accessing the jobkeeper subsidy

If you are a business owner please feel free to self-assess your eligibility to the JobKeeper payments and if you require any assistance we are more than happy to do so. If you do require a helping hand, please email us at clientcare@mckinleyplowman.com.au

Once you have determined your eligibility, the next steps are to enrol, apply, set up your payroll software, and report on the JobKeeper payments.

jobkeeper enrolment

We can take care of your JobKeeper enrolment for you; however if you would prefer to enrol for JobKeeper yourself, please note that you will need to have an active Business Portal and setup your MyGovID account. Below is a link to assist you with this.

https://www.mygovid.gov.au/how-do-i-get-set-up

If you have an active Business Portal account, you should see the following banner when you are logged in

jobkeeper application

jobkeeper reporting and payroll setup

Once your business has registered and made a claim, there shall be ongoing reporting obligations with the employees and the ATO. To see the full process please refer to the following ATO link: https://www.ato.gov.au/general/jobkeeper-payment/employers/enrol-and-apply-for-the-jobkeeper-payment/

- You will be required to report revenue and eligible employee details, and provide these each month to the ATO. In most cases, the ATO will use Single Touch Payroll (STP) to pre-populate the information.

- Alternatively, for businesses that are not GST registered (or not using STP) then the information may be reported manually via the business portal.

costs

what’s next?

NOTES:

- All employers should review their eligibility for the JobKeeper payment and keep details of this for the Australian Taxation Office (ATO). If you are not eligible in March, you may become eligible in future periods. It is also worthwhile noting that once eligible you are NOT required to retest your decline in turnover to remain eligible.

- Once registered you will need to follow the steps outlined by the ATO to make a claim for the JobKeeper payment – you can do that here.

- Please be aware that sole traders can nominate themselves as an eligible employee even if they do not have other staff. Once the details are processed, you will receive payments on a monthly basis. You should also inform employees who are eligible that they are receiving the JobKeeper allowance.

- For other businesses, a nomination can be made to claim the JobKeeper payment for ONE ‘business participant’ (only). Depending on your business structure, the ‘business participant’ can be a partner of a partnership, adult beneficiary of a trust, or, director/shareholder of a company that is not already claiming the JobKeeper payment as an employee.

- IMPORTANT: Unlike other employees, a sole trader/business who has nominated a ‘business participant’ DOES NOT need to pay the JobKeeper payment out to the nominee. The sole trader/business itself can retain the $1,500 per fortnight and effectively use it to assist their cashflow.

Note: As the JobKeeper payment for a ‘business participant’ is not paid out to an employee it is included in the assessable income of that business.

Please be aware that the JobKeeper payment is now law, however, powers have been granted to modify the Stimulus package (if required) so details may still change. McKinley Plowman will aim to provide ongoing updates regarding the JobKeeper payments and other Stimulus packages as they progress.

jobkeeper payments

Once the registration and application for the JobKeeper subsidy is completed, expect that the payments will commence in May (backdated for the first JobKeeper fortnight period from 30 March 2020 to 12 April 2020). Employers should also advise their eligible employees of any amounts paid to them as a JobKeeper payment.

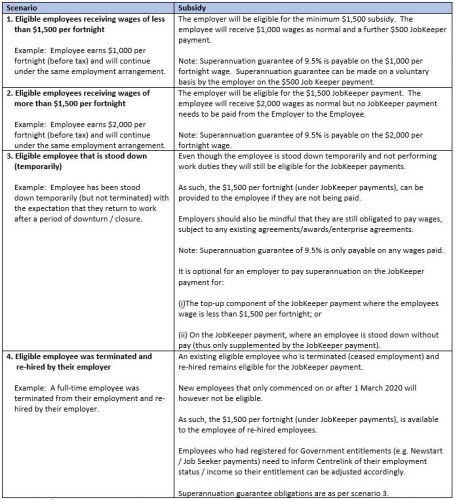

To summarise how the JobKeeper payments will work in practice, please see below:

further information (ato)

eligible employees

If you are an employee, you’ll find helpful information below and via the following links:

JobKeeper Frequently Asked Questions

ATO JobKeeper Information for Employees

Employees are not required to take any action and will be provided a JobKeeper payment by their employers should they be entitled. For employees who have run into employment troubles as a result of the COVID-19 outbreak the employees must meet the following conditions:

- The employee must have been employed by the relevant employer as at 1 March 2020;

- Continue to be currently employed by the employer (including those who have been stood down, or, re-hired);

- Be employed on a full-time or part-time basis;

- Be employed as a long-term casual, which is defined as someone who is employed as a casual worker, who has worked regularly for the same employer for a period of 12 months or more (as at 1 March).

- Eligible employees must also be at least 16 years of age;

- An employer is not entitled to receive a subsidy payment for any employees who are eligible for the JobKeeper payment with another employer.

- Temporary resident visa holders are generally ineligible, except for those holding a Protected Special Category Visa, Non-protected Special Category Visa who have continually resided within Australia for 10 years (or more) and New Zealand citizens holding a (Subclass 444) Visa.

How McKinley Plowman Can Help

Dealing with the ATO in this stressful time is likely the last thing you want to do. At MP+ we’re on hand to help with registering your interest in the JobKeeper subsidy, and the subsequent application process. As we mentioned earlier, if you would like us to liaise with the ATO on your behalf, please email us here and we will be glad to assist where we can.

2. JobKeeper 2.0 – The Next Chapter

**updated following announcement on 6 august 2020**

The original JobKeeper payment was announced by the Federal Government in late March 2020 in response to COVID-19 and comprised a $1500 per fortnight wage subsidy for businesses so they could continue to pay eligible workers. For the most part, this payment helped keep people employed and their heads above water, and around 920,000 organisations and approximately 3.5 million individuals have benefited from the scheme so far. This reflects 30% of employment in the private sector before the pandemic.

Much has been made of the Government’s plans to end the JobKeeper program at the end of September, with many concerned that businesses and workers will struggle should it not be extended. On 21 July 2020, an announcement was made by the Government outlining its plans to extend the JobKeeper program to 28 March 2021, with reduced payment rates and employee access in force from 28 September 2020. Then on 6 August 2020, further changes to JobKeeper 2.0 were announced, and those have been included in the post below.

So – what will JobKeeper 2.0 mean for your business or your job?

jobkeeper 2.0 – employers

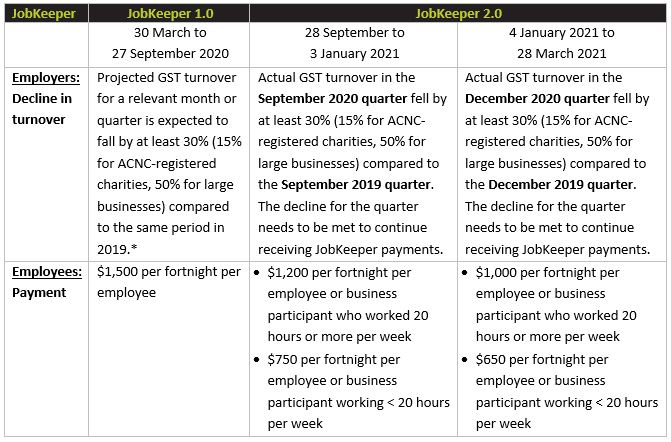

For the second iteration of the JobKeeper scheme, the eligibility test for employers, as well as the amount paid to employees, has changed. In order to continue to receive JobKeeper payments for eligible employees beyond 28 September 2020, businesses will need to reassess their eligibility against by comparing aggregated actual GST turnover figures for the relevant periods (more details in the table under the heading “Summary – JobKeeper 1.0 to 2.0” below). This means:

- For payments from 28 September 2020 to 3 January 2021, turnover must be assessed for the September 2020 quarter against the September quarter from 2019; and

- For payments from 4 January 2021 to 28 March 2021, turnover must be assessed for the December 2020 quarter against the December 2019 quarter.

For illustrative purposes, the following is a practical example of how the new eligibility rules are applied:

Jane’s Jewellery Store:

- JobKeeper Payments 28 September 2020 – 3 January 2021

- In order to assess her eligibility for above payment period, Jane compares her turnover for September quarter 2020 with September quarter 2019 and finds a reduction of 33%.

- The business will be eligible for JobKeeper 2.0 payments for the period 28 September 2020 – 3 January 2021 because each the quarter satisfies the 30% decline in turnover test.

- JobKeeper Payments 4 January 2021 – 28 March 2021

- In January 2021, Jane has the data she requires to assess her eligibility for the second phase of the JobKeeper 2.0 payment period, 4 January 2021 – 28 March 2021.

- She compares her turnover for the December quarter 2020 with the December quarter 2019 and finds her turnover only reduced by 10%.

- As such, Jane’s turnover reduction now falls short of the required 30% reduction for the December quarter, and her Jewellery Store will not be eligible for the JobKeeper 2.0 payments from 4 January 2021 – 28 March 2021. This is despite satisfying the turnover decline for the previous quarters.

Business Activity Statement (BAS) reporting will be the most common port of call for businesses to assess any reduction in turnover and other eligibility factors. That said, BAS deadlines usually don’t fall until the month following the end of the quarter, so businesses will be required to assess their eligibility for JobKeeper 2.0 ahead of the normal BAS deadline. Note that the ATO can use its discretion to extend the time that a business has to pay employees in order to meet the wage condition.

jobkeeper 2.0 – employees

Upon the introduction of JobKeeper 2.0 at the end of September, the amount paid out to employees through the JobKeeper program will be reduced, and must have been employed as of 1 July 2020 as a full-time, part-time or fixed-term employee (or were a long-term casual as of 1 July 2020). This is extended forward from the original required start date of 1 March 2020 (or the requirement to have been long-term casual for 1 year up to 1 March 2020).

The new lower JobKeeper payments starting from 28 September 2020 will be based on hours per week worked, on average, in the four weeks of pay periods up to 1 March 2020 or 1 July 2020. The rate of payment will differ between those who usually work less than 20 hours per week and those who work 20 or more hours per week. Check the table below for details on the differences in payments. In situations where the hours worked by an employee or eligible business participant were not “usual” during February 2020, alternative tests may be made available by the ATO at a later date. Guidance is also yet to be provided regarding non-weekly pay periods, as well as the application of alternative tests under JobKeeper 2.0.

summary – jobkeeper 1.0 to 2.0

A summary of the changes to the JobKeeper scheme, between 1.0 and 2.0, are as follows:

* Alternative tests potentially apply where a business fails the basic test and does not have a relevant comparison period.

final words

It is worth remembering that if your business and workers have been accessing JobKeeper through the original tests, and wage requirements have been fulfilled up to this point, you will still be able to claim JobKeeper payments until the changes are brought into effect for the fortnight starting 28 September 2020. Now that there is some clarity on the tests and criteria around JobKeeper 2.0, now is the time to start planning for the changeover.

The details in this article are correct as of 7 August 2020, and MP+ will continue to provide updates as they come to light.

If we have assisted you with the original registration and reporting requirements for JobKeeper 1.0, we will continue to do so through the changes as well. If you haven’t yet engaged our services to guide you through JobKeeper but would now like our assistance, we’re happy to help. Don’t hesitate to get in touch with McKinley Plowman today on 08 9301 2200 or visit www.mckinleyplowman.com.au.

3. Bank Care Package

The Australian Banking Association (ABA) has announced a relief package that includes a deferral of principal and interest repayments for all term loans and retail loans for six months for small business customers with less than $3 million in total debt owed to credit providers. At the end of the deferral period, businesses will not be required to pay the deferred interest in a lump sum. Either the term of the loan will be extended, or the level of loan repayments will be increased. The package applies to all ABA member banks who agree to participate (listed below). Funders outside of the ABA who are providing support are also listed below:

ABA Members

Commonwealth Bank of Australia

Non ABA Members

4. Coronavirus SME Guarantee Scheme

This Scheme is designed to provide working capital support to SME’s (businesses with turnover of less than $50 million) to reduce the impact of Coronavirus. Under the Scheme, the Federal government will guarantee 50 per cent of new SME unsecured loans issued by eligible lenders up to the value of $250,000. This effectively represents a guarantee of $125,000.

The government will encourage lenders to provide facilities to SMEs that only have to be drawn if needed by the SME, and will remain available into the future, with interest only on the funds that are drawn down. The Scheme will commence in April 2020 and loans will be made available by participating lenders until 30 September 2020. The loans will be made under a term of 3 years with an initial 6 month repayment holiday. No assets will be required as security for these loans.

These conditions apply only to new loans, not refinanced loans. No fees will be payable on the establishment of the loans.

SME Loan Guarantee Scheme Extension & Expansion

Back in May, the Federal Government announced the SME Loan Guarantee Scheme, whereby the Government aimed to improve the ability and likelihood of lenders providing credit for small to medium business owners by providing a guarantee of 50% to Small to Medium Enterprise (SME) lenders. This applied to new unsecured loans to be used for working capital, available to SMEs with a turnover of up to $50 million. Under the initial phase (up to 30 September 2020), the maximum size of the loans guaranteed as part of the scheme is $250,000 per borrower unsecured, with terms up to 3 years (with initial 6 month repayment holiday).

On 20 July 2020, the Government announced further changes to the scheme, which will take effect from 1 October and last until 30 June 2021. The changes are as follows:

- The loans guaranteed under Phase 2 of the scheme may be used for a wider scope of business needs, including investment in businesses to stimulate economic recovery;

- The maximum loan size has been increased from $250,000 $1 million per borrower;

- The loan term can be up to 5 years (not 3 years as per Phase 1). The Six-month repayment holiday will be at the lender’s discretion;

- The loan can be unsecured or secured (excluding residential or commercial property)

What won’t change:

- Loans will still be subject to the credit assessment processes of each lender;

- Management of loans under the scheme, and any decisions to extend credit, remain the responsibility of the lender;

- Lenders are still expected to take into account the uncertainty of current economic conditions.

Lenders will be encouraged to provide SME loan facilities that allow business owners to draw down only what they need, when they need it – and therefore only incur interest on those amounts. This flexibility allows businesses to take only what’s necessary for their financial recovery, working capital improvement or investment needs without incurring unnecessary interest charges.

How to Apply: If you think you may be eligible for the SME Guarantee Scheme and would like to find out more about how to take advantage of it, get in touch with your lender/financial institution.

5. ATO Relief – Pay As You Go Withholding (PAYGW)

Initially announced in the first government stimulus, a $25,000 PAYGW Rebate was announced to apply for the March and June quarters. This was a minimum rebate of $2,000 and a maximum $25,000 rebate (not cash refund) equal to 50% of the PAYGW. If the employer has employees but PAYGW withholding is nil the minimum rebate was $2,000. This has now been revised as a part of phase 2, and now looks like this:

The rebate for March and June is doubled from $25,000 to $50,000 (in total), AND based on 100% of PAYGW rather than 50%.

If an employer has nil PAYGW, the minimum cash payment has increased from $2,000 to $10,000.

A cash refund has been added for June and September equal to 50% of the amount received under phase 1 of the stimulus (per quarter).

As an example, an employer that pays $35,000 PAYGW per quarter will have the following stimulus:

Phase 1 – PAYGW Rebate

- $35,000 PAYGW rebate (March quarter)

- $15,000 PAYGW rebate (June quarter) as $50,000 cap is reached

Phase 2 – PAYGW Cash Bonus

- $25,000 cash payment for June quarter i.e. 50% of PAYGW rebates

- $25,000 cash payment for September quarter i.e. 50% of PAYGW rebates

Total stimulus $100,000

As an example, an employer with wages but NIL PAYGW will have the following stimulus:

Phase 1 – PAYGW Rebate

- $10,000 PAYGW rebate (March quarter)

- $0 PAYGW rebate as $10,000 cap paid applies in March (in full)

Phase 2 – PAYGW Cash Bonus

- $5,000 cash payment for June quarter i.e. 50% of PAYGW rebates

- $5,000 cash payment for September quarter i.e. 50% of PAYGW rebates

Total stimulus $20,000.

Note: There is currently no guidance on whether Gross wage needs to be greater than $10,000 before the rebate can be received in full.

Other points:

- The business must have had employees before 12 March 2020.

- The rebate/cash payment applies to businesses with an aggregated turnover of up to $50m.

- The cash payments received are tax free.

- The business must continue to remain active in June/September to have entitlement to the cash payments.

- The cash stimulus is applied as an automatic “CREDIT” for the June/September Activity Statement lodgements. This suggests that if there is an existing debt or the BAS is not paid in full then a cash payment would not be forthcoming.

- Do not forget superannuation guarantee obligations, which will still stand and ineligible for the amnesty which only applies for SGC up to 31 March 2018. This may be extended, but at this point in time no announcements have been made in this regard.

Basically, to access the PAYGW stimulus, you simply need to lodge your activity statements as normal, the rebates and cash stimulus should then be applied automatically.

Note: We recommend talking to us well before June 30 about your estimated current year income and wages to enable us to maximise your stimulus entitlement. Watch out for our tax planning newsletter in early April.

6. ATO Relief – Tax Payment Deferral Options

Deferring by up to four months the payment date for BAS amounts due (including PAYG instalments), income tax assessments, FBT assessments and excise. Also:

- Allowing businesses to vary PAYG instalment amounts to zero for the March 2020 quarter; businesses that vary their PAYG instalment to zero can also claim a refund for any instalments made for the September 2019 and December 2019 quarters;

- Remitting any interest and penalties, incurred on or after 23 January 2020, that have been applied to outstanding tax liabilities;

- Working with affected businesses to help them pay their existing and ongoing tax liabilities by allowing them to enter into low-interest payment plans;

- Allowing businesses on a quarterly reporting cycle to opt into monthly GST reporting in order to get quicker access to GST refunds they may be entitled to.

Whilst interest and penalty remissions are automatic, actions will be required to implement the other options. We can assist with this if required.

7. Instant Asset Write Offs and Accelerated Depreciation

Applicable to assets purchased after the 12th March 2020, an increase in the instant asset write off threshold from $30,000 to $150,000 and expanding access to these write-offs to include businesses with aggregated annual turnover of less than $500 million until 30 June 2020.

For assets with a purchase price of more than $150,000 or purchased after 30 June 2020, businesses with aggregated annual turnover of less than $500 million, in addition to the standard depreciation a claim for assets, will be able to deduct 50% of the asset cost in the year of purchase via a time limited 15 month investment incentive through to 30 June 2021.

For example,

- Assuming that a business purchases equipment for $250,000 (exclusive of GST) in May 2020.

- In the 2020 tax return the business would claim an upfront deduction of $125,000. The business would also claim a further deduction for the depreciation that would have arisen on the balance of the cost.

- Assuming a depreciation rate of 15% per annum, this would mean an additional deduction of $18,750 per annum (i.e. 15% x $125,000).

- Without the introduction of this investment incentive the business would have claimed a deduction of $37,500 per annum (i.e., 15% x $250,000).

Note: Currently, there are restrictions regarding the limits on motor vehicle claims (currently $57,581), once legislation is released we will be able to provide further guidance.

Note 2: The decision to acquire an asset should consider the return on investment and future cash flow of your business.

8. Superannuation & Social Security for Individuals and Sole Traders

Early release of superannuation

The Government will allow individuals in financial stress to access up to $10,000 of their superannuation in the 2020 financial year and a further $10,000 in the 2021 financial year.

To be eligible for early release of superannuation you must be either have:

- Been unemployed, or

- Been eligible to receive Jobseeker payment, Youth Allowance for job seekers, Parenting Payment, Special Benefit or Farm Household Allowance, or

- Been made redundant on or after 1 January 2020, or

- Had your working hours reduced by 20 percent or more, or if you were a sole trader had your business suspended or experienced a reduction in your turnover of 20 percent or more

Those who are eligible are able to apply through the myGov website www.my.gov.au from mid April 2020 to access the funds before 1 July 2020 for the first $10,000 and have three months after this date to access more. These funds will not be taxed and will not affect Centrelink or Veterans’ Affairs payments.

This is generally a last resort, however it may be a viable option for some individuals during a downturn. Seek appropriate advice before making any decisions.

Superannuation pensions minimum draw down rates

The Government is temporarily reducing the superannuation minimum draw down requirements for account based pensions and similar products by 50% for the 2019/20 and 2020/21 financial years. This will provide more flexibility as to how superannuants manage their superannuation assets. The government has reduces the draw down rates to buffer the withdrawal of superannuation whilst the financial markets respond to COVID-19.

No Relief for Employer Super Obligations

Employers will still need to meet their ongoing super guarantee obligations for their employees, which are payable by 28th day after the end of every quarter.

Social Security Deeming Rates

The Government is reducing the deeming rate adopted for Age Pension income testing by a further 0.25 percentage points to reflect the latest rate reductions by the RBA. As of 1 May 2020, the upper deeming rate will be 2.25 per cent and the lower deeming rate will be 0.25 per cent. This is intended to reduce deemed income when assessing social security entitlements, thus providing greater access.

9. Income Support For Individuals & Sole Traders

Two $750 stimulus payments to pensioners, social security, veteran and other income support recipients and eligible concession card holders. The first of these payments was announced on 12 March 2020 and the second will be automatically made on 13 July 2020. The payment will be tax-free and will not count as income for social security, farm household allowance, and veteran payments.

From 27 April 2020, the Government is also temporarily expanding eligibility to income support payments to include sole traders and establishing a new time limited Coronavirus Supplement to be paid at a rate of $550 per fortnight for the next 6 months on top of existing entitlements.

The Coronavirus Supplement will be paid to both existing and new recipients of the JobSeeker Payment, Youth Allowance, Parenting Payment, Farm Household Allowance and Special Benefit and be in addition to the payments made on under these allowances.

The Jobseeker payment is currently $550 per fortnight and the addition of the Coronavirus Supplement increases this payment to $1,100 per fortnight.

Sole traders and casual workers who are currently making less than $1,075 a fortnight will be eligible to receive the full supplement.

CLICK HERE FOR THE GOVERNMENT’S INCOME SUPPORT FACT SHEET

10. Apprentice Relief

The government has introduced a wage subsidy to support small businesses to retain their apprentices and trainees. Businesses may be eligible to receive 50 per cent of their apprentice’s wages, capping at $21,000, per apprentice, for the nine months from 1 January 2020 to 30 September 2020.

Employers will be able to access the subsidy after an eligibility assessment is undertaken by an Australian Apprenticeship Support Network provider. Like other assessments, this is expected to be completed via a SmartForm on the Australian Apprenticeship website.

Employers can register for the subsidy from 31 March 2020, and final claims of payment must be lodged by 31 December 2020.

11. Payroll Tax (WA)

Businesses paying payroll tax, with a payroll between $1m and $4m will receive a one-off grant of $17,500. The grant is automatic, with cheques expected to be issued in July 2020 (see note below).

In addition, the increase of the payroll tax threshold to $1m will be fast-tracked to 1 July 2020, six months before the originally planned date. This means smaller businesses will potentially be able to fall out of the payroll tax regime sooner than before.

Payroll tax will be waived for March to June for employers who have Australian taxable wages of less than $7.5 million at 30 June 2020. This waiver replaces the previously announced option to defer payment of payroll tax until July.

Note: For employers grouped for payroll tax only a single grant will be paid to the designated group employer

12. Land Tax Deferral

Landowners due to pay 2020 land tax that have at least one non-residential property and total taxable landholdings below $1 million have the option of deferring their 2020 land tax payment until after 30 June 2020. The State Revenue Office will contact all taxpayers who are eligible for this deferral.

13. Staff considerations

Employee Leave Queries

The World Health Organisation (WHO) declared Coronavirus (COVID-19) a pandemic on 11 March 2020. With the impact of COVID-19 changing the business landscape daily, it is unsurprising that employers have been left asking “but what does this mean for my business and workforce?” Check out Coronavirus and the Workplace for guidance around what you can do to best meet your obligations and support your staff.

Workcover & Working From Home

An important point to note is where your team are working from home, their home becomes a place of work and is therefore covered by Workcover. Please see a link to a government checklist to assist in identifying any risks associated with working from home: https://maps.finance.gov.au/sites/default/files/2019-08/form_151.pdf

Fair Work Requirements

We have attached a link to the Fair Work Ombudsman website that addresses Coronavirus and Australian Workplace Laws. https://www.fairwork.gov.au/about-us/news-and-media-releases/website-news/coronavirus-and-australian-workplace-laws

14. Insolvency – Temporary Relief for Financially Distressed Businesses

The Government has announced temporary changes on insolvency laws (Corporations Act 2001). These proposed changes are designed to give businesses time to assess their solvency, implement restructuring plans where needed and take advantage of the safe harbour provisions under the Corporations Act 2001.

The most notable changes are:

- A temporary increase in the statutory demand threshold to $20,000;

- An increase in the time to comply with a statutory demand from 21 days to 6 months;

- A temporary increase in the size of the debt required to issue a creditor’s petition to $20,000;

- An increase in the time to comply with a bankruptcy notice from 21 days to 6 months;

- The moratorium on action against a debtor following the presentation of a declaration of intent to present a debtor’s petition is increased to 6 months; and

- A six-month moratorium on directors’ insolvent trading liability, for debts incurred in the ordinary course of business.

15. Retail and commercial leases

The National Cabinet has released a mandatory Code of Conduct for commercial leasing agreements that outlines good faith leasing principles between landlords and tenants, where the tenant is an eligible business for the purpose of the Commonwealth Government’s JobKeeper programme. Some guidelines include: Landlords must offer tenants proportionate reductions in rent, i.e in the same proportion of the reduction in tenant’s revenue, in the form of waivers and deferrals; Landlords must not terminate leases due to non-payment of rent during the COVID-19 pandemic period (or reasonable subsequent recovery period); Tenants must remain committed to the terms of their lease, subject to any amendments to their rental agreement negotiated under this Code; and Any reduction in statutory charges (e.g. land tax, council rates) or insurance will be passed on to the tenant in the appropriate proportion applicable under the terms of the lease.

16. Key practical business considerations

We expect that all businesses will be impacted in some manner. We strongly suggest that you spend some time considering the potential impacts on your business and personal life, should things escalate. We have listed some practical considerations to help you think about:

Forecasting

- Prepare a short term cash flow forecast (3 months) broken down into weekly cash flows, assuming a drop in revenue and identify the impact on your cash flow and work through what potential strategies you could adopt around costs savings and protecting revenue.

- McKinley Plowman’s Business Services team are on hand to help you prepare 3-way cash flow forecasts – Profit & Loss; Balance Sheet; and Cash Flow. It’s important to know the cash flow and profit position of your business as lenders are likely to request this information, should you apply for support with your finance.

People

- Speak to staff about short term job sharing or moving to part time employment rather than redundancies

- Consider short term salary cuts for higher salaried employees

- Communicating with staff about your policies, expectations and interactions with clients and customers – see Coronavirus and the Workplace article here.

- Consider workflow planning should there be personnel disruptions, managing casual staff/paying full time wages while on leave.

- Consider working from home requirements

- Consider Fair Work requirements for employees that may have been exposed to the virus.

Cashflow

- Know your cash flow position

- Consider how your product mix and sales strategy may need to change to reduce the impact of, or take advantage of, current conditions

- Revisit your marketing plan and strategy to investigate how to promote your business in low cost way

- Eliminate all non-essential or discretionary expenditure

- Reduce your labour costs – refer to section above

- Consider your operating hours to reduce running costs of your business

- Discuss reducing or deferring rent with your landlord

- Discuss converting your debt to interest only with your bank or seeking a repayment holiday as outlined above

- Review cash flow relief and support options provided by ATO and SRO as outlined above

- Identify other options for short term sources of finance

- Debtors

- Offer discounts for payment

- Agree payment plans where required

- Seek upfront payments for services where appropriate

- Make sure your terms and conditions are structured adequately and protect your right to recovered debts

- Suppliers

- Proactively communicate with key suppliers and delay payments or negotiate extended payment terms

- Reduce the number of suppliers who are owed funds by clearing smaller debt as this will reduce the number of suppliers you may be required to negotiate with

- Negotiate payment discounts

- Reduce stock levels

- Sell surplus assets that do not have debt attached to them

- Consider payment plans or deferral for personal expenses such as school fees

17. COVID-19 Lending Guide

During this difficult and unprecedented time, you may be faced with some financial uncertainty. As such, we wanted to reach out to provide some resources and support regarding your finances which may help if you have been adversely affected by Covid-19. We have also provided some options for those clients who have not been impacted by Coronavirus, but still want to reduce their monthly costs.

As you may be aware, the majority of lenders have provided relief packages in conjunction with the Federal Government. More guidance on the stimulus packages can be found here. Contacting us or your lender directly should be your first step if you’re struggling to make your repayments due to unforeseen circumstances.

Currently, lenders are offering a deferral of home loan repayments for up to six months (with interest capitalised), as well as reduced fixed rates for owner occupiers paying principal & interest repayments, with some as low as 2.19%.

Note that if your income has been affected by Covid-19, consider using the loan repayment deferment as your last choice if possible. If you choose this option, the loan repayments are not required to be paid for up to 6 months, however the interest will be capitalised to your loan. This means that after the 6-month period, you will owe more than the loan balance you started at before you deferred. It is also worth noting that the Covid-19 assistance is not automatic, and your lender will ask a few questions to understand your situation and assess your eligibility.

Example: If you have a $400,000 loan at an interest rate of 3%, and choose to defer, after the 6-month deferment period, you will owe $406,000. The banks have agreed to extend the deferred loans for a further 6 months, however before choosing to defer you may want to consider some other options:

- Access your redraw and/or offset funds to assist with loan repayments.

- If paying more than minimum repayment amount, reduce your repayments to the minimum required

- Change your repayments to Interest only. Remember – if you choose this option, your repayments may be higher when the loan is converted back to principal & interest repayments as the overall loan term has reduced.

- Seek a pricing discount from your existing lender to reduce repayments.

- A deferral of business loan repayments, including equipment/vehicle finance, for up to six months with interest capitalised for business loans now up to $10 million.

- Reduced rates on Overdraft facilities and some business loans

- Merchant terminal rental fee waivers

- Deferred payments for business credit cards for up to three months

- Fee-free redraws for those business loans with redraw available

- Unsecured $250,000.00 business loan 50% guaranteed by the Federal Government

- For the first six months, all repayments are deferred.

- For the remaining term of the loan, amortising principal and interest repayments will be applicable.

- No establishment or account fees.

- Performing a health check on your loans and submitting a pricing request to reduce rates with your existing lenders if required;

- Re-financing your loans, should your existing lender not want to meet market rates. For those in a position to re-finance, there are some very low rates on offer for fixed and variable rate options, plus some lenders offering up to $4,000 to refinance; and/or

- Restructuring and consolidating your loans, should this be beneficial.

18. WA COVID-19 Business and Industry Advice

Along with the Federal Government, the Western Australian Government has also implemented a range of measures to support business and industry in WA. The link below will take you to their information page about the stimulus measures they will be making available.

WA GOVERNMENT COVID-19 BUSINESS & INDUSTRY ADVICE

19. JobTrainer Program

The Federal and State Governments have spent billions of dollars over the past few months in response to COVID-19 in the form of stimulus measures such as JobKeeper payments and an increase of the Instant Asset Write-Off threshold. Where schemes like these exist to keep businesses afloat; allow individuals to retain employment; and sustain spending in the economy; the latest announcement from the Government takes a slightly different approach.

The JobTrainer program has two main aims: first is to proactively upskill Australians to be able to gain or keep employment in sectors with greater job opportunities and are crucial to the economy’s recovery and growth. The second aim is to incentivise employers to take on and retain apprentices by extending the existing apprentice wage subsid. Approximately $2.5 billion will be invested into the scheme and with incentives on offer for both employers and employees, the future for the job market and broader economy appear a little clearer.

Employees & JobTrainer

In a job market that’s flooded with people who have been stood down or made redundant as a result of COVID-19, the prospects for those searching for employment are pretty bleak at the moment. The JobTrainer scheme will look to open up nearly 350,000 training places for high school leavers and job seekers so they can participate in short- and long-term courses, developing new skills in economic growth sectors. The Federal Government is still in the process of determining which qualifications and skillsets are most in-demand and crucial to the greater economic recovery process, and this will guide the courses that will be offered.

Employers & JobTrainer

While it looks at this stage that the training course programs won’t have much of an impact on businesses in the short term, the long-term goal is to create a large pool of potential workers that have the requisite skills to perform important and economically stimulating jobs. This is especially pertinent as many of the jobs hit hardest in the mass redundancies and standing down of employees as a result of COVID-19 won’t be the same jobs required as the economy rebuilds.

Another feature of the JobTrainer program with a more immediate impact is the extension of the existing apprentice wage subsidy. This means that employers with up to 200 employees (increased from up to 20) can access a 50% wage subsidy for apprentices employed from 1 July 2020. Practically speaking, eligible employers will be reimbursed 50% for each eligible apprentice’s wage up to $7,000 per quarter. The bottom line here is that more businesses are able to access the apprentice wage subsidy and potentially increase the number of apprenticeships on offer.

McKinley Plowman’s Status

During what is an unprecedented and enormously challenging time for businesses and individuals alike, the MP+ team is working tirelessly to ensure that the impact of COVID-19 is minimised as much as possible for all of our clients; and we’re aiming to help you navigate this crisis with a level head and professionalism.

Our current working situation is as normal, with our team working from the office. Should this change, however, we have the necessary infrastructure in place to allow our staff to work remotely, and we will update you in such an event with necessary contact information. Our priority remains with you, our clients, and we are doing everything we can to guide you through this tough time.

The broad range of services we provide means we can assist with just about any aspect of the government’s stimulus measures. This includes 3-way cash flow projections; help with Centrelink application forms; accessing superannuation; bank finance; maximising stimulus entitlements; and much more.

Please do not hesitate to get in touch with us on (08) 9301 2200, via email at clientcare@mckinleyplowman.com.au, or through our website at https://www.mckinleyplowman.com.au/ for any enquiries you may have.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today