partners for life

UK State Pensions: Mitigating the Impact of Inflation and Market Volatility

Rising inflation across the globe is having an impact on just about every industry, family and business. This includes property market dynamics, rising home loan repayments, strained household budgets and the rising cost of living. UK expats looking to claim the State Pension in Australia may also feel the effects. If you have previously worked in the UK and made National Insurance (NI) contributions and are therefore eligible for the UK State Pension (assess your eligibility here), read on to find out how you may be able to maximise your retirement income and increase certainty in these uncertain times.

2023 UK State Pension Increase

Part of the UK Government’s response to rising inflation has been to announce a 10% increase in State Pension Payments next year. This is a significantly higher increase than normal, with it usually capped at 2.5% annually. While this is welcome news for pensioners in the UK who have been struggling to cope with rising cost of living pressures, those already claiming the UK State Pension in Australia won’t receive the same increase. Therefore it is important that if you are eligible, you should consider topping up your pension benefit so you can lock in this above average increase on a larger portion of the state pension. In a world that is so volatile and unpredictable, knowing that this increase is on the cards should provide some certainty to those who plan to claim the UK State Pension.

UK State Pension – Increasing Certainty in Retirement

The volatility we are seeing in the global markets right now could well be long and protracted, as the conflict in Ukraine carries on, central banks grapple with inflation, interest rates continue to bite and geopolitical risks between the US and China persist. Therefore, anything that increases certainty in retirement is great for retirees. This is where “Income Layering” can play an important part in funding your retirement. Income layering refers to having a secure level of income that covers the essentials – utilities, healthcare, accommodation, groceries, etc. that isn’t linked to market performance. The Age Pension from Centrelink or the UK State Pension are great examples of this type of income. Meanwhile, you can layer other sources of income, for instance through investments or super, that may provide a greater source of income should they perform well, but you aren’t solely reliant on that to be able to afford the essentials.

UK State Pension – Topping Up

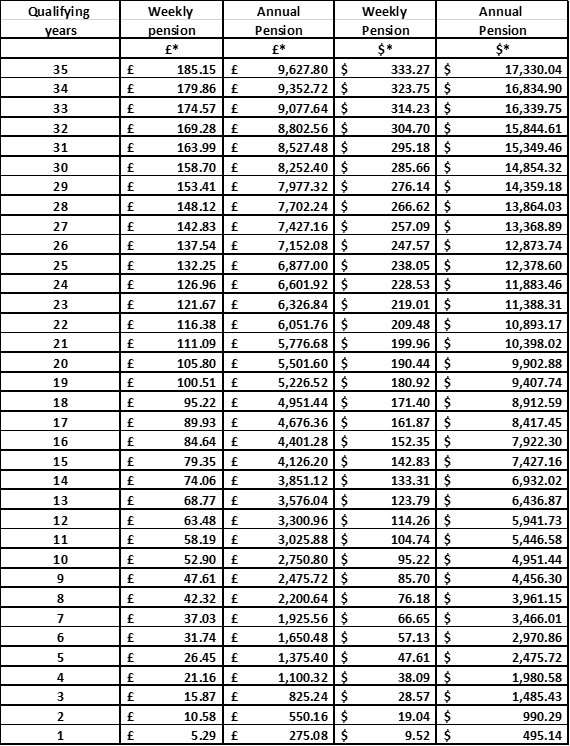

If you are eligible for the UK State Pension, you can top up your National Insurance contributions to increase the Pension amount you will receive when you retire and improve certainty against rising inflation. Even if you are only able to top up to the minimum of 10 years’ of NI contributions, this still affords you additional income that, once claimed, isn’t at the mercy of volatile global markets and could provide a handy boost to your income as the cost of living continues to rise. Topping up at Class 2 rates is more cost-effective (currently £3.15 per week) compared to Class 3 rates (£15.30 per week). Below is a table that indicates the weekly UK State Pension in GBP and AUD, as of April 2022. As you will notice, your pension amount depends on how many years of NI contributions you have made, indicating why topping up can increase your entitlements.

UK State Pension Rates April 2022

Note the figures above are based on rates as of 05 April 2022, and an illustrative example assumed £1/$1.80. Due to pending legislation changes, if you have less than 10 complete UK Tax years’ contributions, you will NOT be eligible to claim a UK pension, although you have paid into this. It is prudent to at least make sure that you have topped up the full 10 years, rather than lose your entitlement.

UK State Pension and Centrelink Age Pension

The Australian Age Pension is a means tested benefit provided by CentreLink. The amount of pension received will depend on the amount of income and assets you have. The UK State Pension is counted in the income test when CentreLink calculate your Age Pension. For a couple, every $1 of income earned per fortnight above $336 ($8,736 p.a.), the Age Pension will be reduced by 50 cents for every $1 above this level. The cut off limit, where the income you earn from other sources such as the UK State Pension makes you ineligible to receive the Age Pension from Centrelink is currently $3,313 per fortnight ($86,138 p.a.)

How PTS & McKinley Plowman Can Help

If you have worked in the UK for three or more years, you could be eligible to top up your UK State Pension benefits and maximise your income in retirement, helping to insulate part of your retirement income from inflation pressures. Our UK State Pension top up and claim services have helped numerous clients do just that, either through regular pension payments, or a lump sum amount (plus interest). Get in touch with the Pensions team today on 08 9301 2200, or contact us via our website. You can also click here to download our free UK Pensions e-book.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today