partners for life

Small Business Update – Market Snapshot

For those looking to get into small business, gaining an understanding of the state of the market, competition and current areas of concern is important in guiding business decisions, particularly in the early stages. The Australian Taxation Office (ATO) has recently released some interesting insights into the small business sector, particularly around what small businesses are struggling with at the moment.

Market snapshot

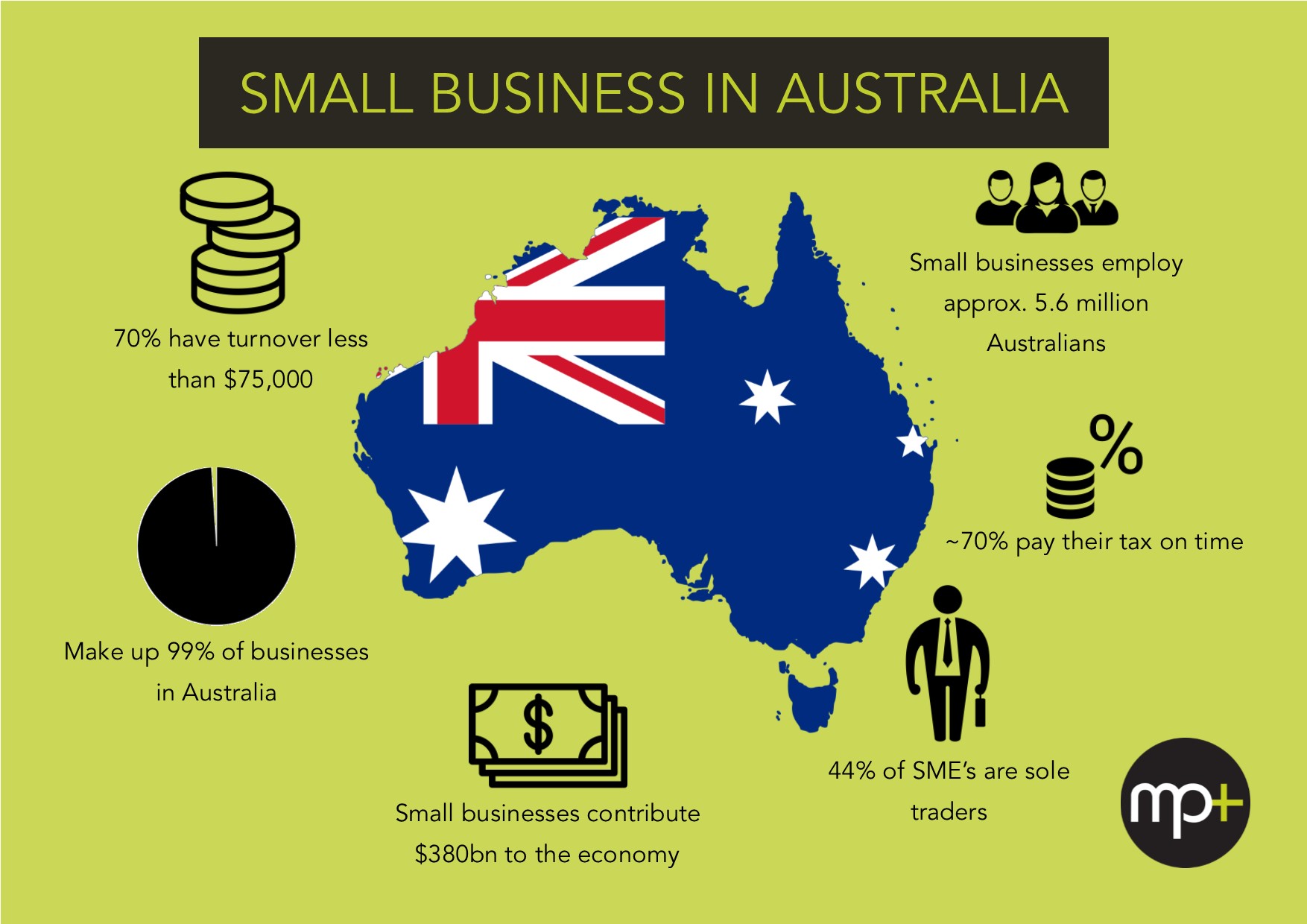

Small businesses are defined by the ATO as entities with an annual turnover of less than $10 million. There are around 4 million of them in Australia, accounting for 99% of all businesses. Below is a brief summary of the current small business market.

Limited tax knowledge & business acumen

Generally speaking, small business owners started their enterprise because they’re passionate about what they do. From florists to plumbers; real estate agents to painters; small business owners know what they’re good at. Unfortunately, however, many aren’t so knowledgeable when it comes to tax and compliance. The ATO often cracks down on particular points of concern when it comes to tax errors, brought about by consistent errors by businesses. Some common problems arising from small businesses and their tax obligations include incorrectly claiming private expenses in the business; the attribution of personal and business use; and a lack of understanding on how tax is applied for different business structures. Small business owners can get around these problems by engaging a business accountant and bookkeeper. Getting the professionals to look after the books ensures compliance with the ATO is not only less time-consuming, but correct.

Business owners are time-poor

This one’s a no-brainer. The vast majority of those running their own business would agree that time really is of the essence, and an overload of work can make it all seem pretty overwhelming. Small businesses are often too busy to adopt new ways of doing business (including using evolving technology), even when making the time to implement new thigs could ultimately improve efficiency and time management longer-term. A lack of time to get things done is also reflected in the poor quality of many business’ bookkeeping and tax output. Running the business and being customer-facing often takes precedence over maintaining good records and keeping up with obligations, and this is where SME’s can sometimes be found out with unexpected tax bills or penalties. Again, the best way to mitigate this is to seek out an accountant. Developing and implementing a tax strategy with the help of a tax consultant is a good proactive approach to minimising your payable tax and potentially increasing returns.

Looking to get into small business, but don’t know where to start? Contact McKinley Plowman today via our website or call us on 08 9301 2200 for a FREE initial consultation.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today