partners for life

JobKeeper Package – What You Need to Know

The Australian Government has announced a third stimulus package, which is welcome relief for businesses and employees alike. The ‘Job Keeper’ Package will subsidise wages of $1,500 for each eligible employee (per fortnight) for a period of up to six months for all eligible businesses. In case you’ve missed out previous updates on the stimulus packages, feel free to check out the MP+ News Page, Facebook and LinkedIn.The scheme aims to subsidise employees’ wages in order to incentivise business owners to keep people employed and working where possible during the Coronavirus (COVID-19) pandemic. This subsidy applies to a large number of businesses and their employees, so let’s have a look at who is eligible for the payment, and what needs to be done to get it using our three step process.

Eligible Employers – Information

For employers to be able to take advantage of the JobKeeper payment, there are a few eligibility criteria that have to be met.

-

- Business turnover must have reduced by the following amounts as a result of COVID 19:

Business Type Reduction %

Not-for-Profits 15%

Other businesses <= $1billion turnover 30%

Other businesses > $1billion turnover 50%

- Turnover reductions must be calculated based on a comparable calendar month from one year ago (e.g. April 2019 to April 2020). However, a quarterly comparison is available for the quarters ended 30 June and 30 September (if required).

- Please note that some businesses and specific employees are excluded from JobKeeper payments, subject to the disclaimers set out in the calculator below.

JobKeeper Calculator for Employers

As the JobKeeper payment has recently been legislated, business owners should now be assessing their eligibility and possible level of payments receivable.

Below is a link to a JobKeeper calculator, which should give you an idea of the JobKeeper payments that you may be entitled to.

Are you an employer? Click Here to Access our FREE JobKeeper Calculator

What if you do not satisfy the decline in turnover?

For businesses that do not satisfy the turnover test but have still been adversely impacted by COVID-19, there are now new guidelines set out by the ATO which detail how you may still be eligible for JobKeeper, providing you meet special circumstances, which include:

- Businesses that haven’t been trading for 12 months;

- Businesses that were in the process of scaling up;

- Businesses that have been through restructuring, acquisition or merger in the last 12 months; or

- Highly variable turnover or seasonal fluctuations

McKinley Plowman can assist you in assessing your turnover reductions to hep determine your eligibility; as well as evaluating the new alternative tests set out by the ATO, should they apply to your business.

Exceptions

- It is also worth noting that businesses which are subject to the major bank levy (e.g. certain banks / financial institutions) will be ineligible for the JobKeeper Payments.

- This is an ongoing test, so if the above conditions are not satisfied then please reassess on a monthly basis in case your circumstances / eligibility change.

- Please note that some businesses and specific employees are excluded from JobKeeper payments, subject to the disclaimers set out in our calculator (link above).

Eligibility Criteria as a Business Participant

It is important to remember that employees on wages are not the only people that can be eligible for JobKeeper. If you are a business participant who is not paid a normal wage; a sole trader; an adult beneficiary of a trust; a partner in a partnership; or a director/shareholder in a company, you may also be eligible to receive the payments. Below you’ll find some links to the ATO website which outline the eligibility criteria for these different roles; as well as the application form for eligible business participants.

Sole Traders and Other Entities

JobKeeper nomination notice for eligible business participants – excluding sole traders

Business Owners: Accessing the JobKeeper Subsidy

If you are a business owner please feel free to self-assess your eligibility to the JobKeeper payments and if you require any assistance we are more than happy to do so. If you do require a helping hand, please email us at clientcare@mckinleyplowman.com.au

Once you have determined your eligibility, the next steps are to enrol, apply, set up your payroll software, and report on the JobKeeper payments.

JobKeeper Enrolment

JobKeeper Application

JobKeeper Reporting and Payroll Setup

Once your business has registered and made a claim, there shall be ongoing reporting obligations with the employees and the ATO. To see the full process please refer to the following ATO link: https://www.ato.gov.au/general/jobkeeper-payment/employers/enrol-and-apply-for-the-jobkeeper-payment/

- You will be required to report revenue and eligible employee details, and provide these each month to the ATO. In most cases, the ATO will use Single Touch Payroll (STP) to pre-populate the information.

- Alternatively, for businesses that are not GST registered (or not using STP) then the information may be reported manually via the business portal.

Costs

What’s Next?

NOTES:

- All employers should review their eligibility for the JobKeeper payment and keep details of this for the Australian Taxation Office (ATO). If you are not eligible in March, you may become eligible in future periods. It is also worthwhile noting that once eligible you are NOT required to retest your decline in turnover to remain eligible.

- Once registered you will need to follow the steps outlined by the ATO to make a claim for the JobKeeper payment – you can do that here.

- Please be aware that sole traders can nominate themselves as an eligible employee even if they do not have other staff. Once the details are processed, you will receive payments on a monthly basis. You should also inform employees who are eligible that they are receiving the JobKeeper allowance.

- For other businesses, a nomination can be made to claim the JobKeeper payment for ONE ‘business participant’ (only). Depending on your business structure, the ‘business participant’ can be a partner of a partnership, adult beneficiary of a trust, or, director/shareholder of a company that is not already claiming the JobKeeper payment as an employee.

- IMPORTANT: Unlike other employees, a sole trader/business who has nominated a ‘business participant’ DOES NOT need to pay the JobKeeper payment out to the nominee. The sole trader/business itself can retain the $1,500 per fortnight and effectively use it to assist their cashflow.

Note: As the JobKeeper payment for a ‘business participant’ is not paid out to an employee it is included in the assessable income of that business.

Please be aware that the JobKeeper payment is now law, however, powers have been granted to modify the Stimulus package (if required) so details may still change. McKinley Plowman will aim to provide ongoing updates regarding the JobKeeper payments and other Stimulus packages as they progress.

JobKeeper Payments

Once the registration and application for the JobKeeper subsidy is completed, expect that the payments will commence in May (backdated for the first JobKeeper fortnight period from 30 March 2020 to 12 April 2020). Employers should also advise their eligible employees of any amounts paid to them as a JobKeeper payment.

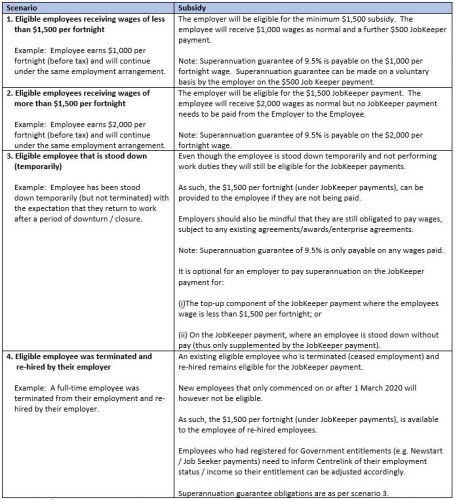

To summarise how the JobKeeper payments will work in practice, please see below:

Further Information (ATO)

Eligible Employees

If you are an employee, you’ll find helpful information below and via the following links:

JobKeeper Frequently Asked Questions

ATO JobKeeper Information for Employees

Employees are not required to take any action and will be provided a JobKeeper payment by their employers should they be entitled. For employees who have run into employment troubles as a result of the COVID-19 outbreak the employees must meet the following conditions:

- The employee must have been employed by the relevant employer as at 1 March 2020;

- Continue to be currently employed by the employer (including those who have been stood down, or, re-hired);

- Be employed on a full-time or part-time basis;

- Be employed as a long-term casual, which is defined as someone who is employed as a casual worker, who has worked regularly for the same employer for a period of 12 months or more (as at 1 March).

- Eligible employees must also be at least 16 years of age;

- An employer is not entitled to receive a subsidy payment for any employees who are eligible for the JobKeeper payment with another employer.

- Temporary resident visa holders are generally ineligible, except for those holding a Protected Special Category Visa, Non-protected Special Category Visa who have continually resided within Australia for 10 years (or more) and New Zealand citizens holding a (Subclass 444) Visa.

How McKinley Plowman Can Help

Dealing with the ATO in this stressful time is likely the last thing you want to do. At MP+ we’re on hand to help with registering your interest in the JobKeeper subsidy, and the subsequent application process. As we mentioned earlier, if you would like us to liaise with the ATO on your behalf, please email us here and we will be glad to assist where we can.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today