partners for life

Business Benchmarking – How Does Yours ‘Stack Up’?

Business Benchmarking – How Does Yours ‘Stack Up’?

Have you ever wondered how your business ‘stacks up’ against other businesses in your industry? What are all the other businesses doing that may be different to yours? What if there was a way you could measure the financial performance of your business on a regular basis? All of the above questions (and many more) can be answered with the use of benchmarking. There are various credible industry benchmarks available to assist in analysing your business performance to see how it compares with the rest of the industry. Here’s how you can use that data to take your business to the next level…

Why Is Benchmarking Important?

Let’s start off with why benchmarking is so important for operating a successful business. After all, taking the time and effort to compare data and make decisions based on that should be in service of an important goal, right? Here are some of the key reasons you should consider benchmarking:

- Contextualise your business’ performance: While solid bookkeeping and reporting practices will give you important insights into your business’ financial position, benchmarking puts that into context against your competitors. For instance, a gross profit margin of 45% might seem okay on face value, but data from your industry might highlight that the average should be closer to 60%. From there, you have the impetus to explore how you can rise to that standard by looking ‘behind the numbers’. For example, is there anything I can be doing differently? Am I passing on the costs from my suppliers’ price increases? Do I need to source different suppliers? When did I last review my pricing methodology? Are some jobs not profitable? And so on…

- Set realistic budgets and targets: When combined with forecasts, the use of benchmarking data allows you to project the future performance of your business with the relevant benchmarks forming key performance indicators (KPI’s) and informing decisions around setting a budget.

- Make better business decisions: You can use forecasts and other data points from benchmarking as a measuring stick when comparing your actual results to your budget, to determine what you have done well and what aspects of the business needs to be improved upon. These comparisons also act as an effective decision-making tool by implementing ‘what-if’ scenarios.

Benchmarking – In Different Shapes and Sizes

Benchmarking can take many forms; however, the most commonly used format is as a percentage or ratio which can be applied to your financial data. Examples of commonly used benchmarks include:

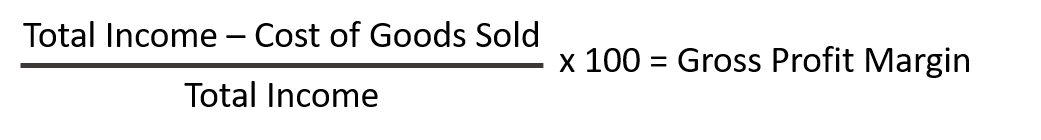

Gross Profit Margin

This ratio helps determine the profitability of your product(s) and service(s). The higher the gross profit margin, the more you are earning for every dollar of revenue. This benchmarking ratio is particularly useful for plumbers, electricians and other trades to determine the profitability of a job when factoring in materials and labour costs. The same applies to manufacturing businesses to ensure that their pricing methodology is correct and covers the costs of producing a product. Additionally, dividing your fixed overheads by this percentage allows you to calculate the revenue required to breakeven.

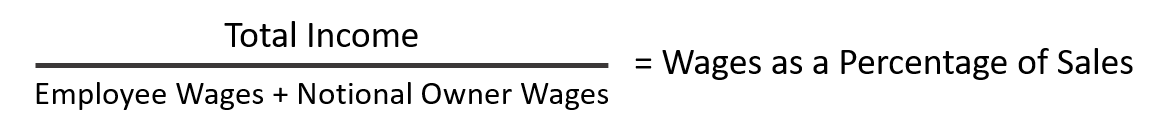

Wages as a % of Sales:

Wages as a percentage of sales allows you to assess the utilisation of your staff by assessing their overall costs in comparison to sales. Should your percentage be significantly higher than the industry benchmark, this may mean that you are paying too much for your staff, you may have too many staff members, or they’re not being as productive as they should be in generating revenue. If the ratio is significantly lower than the industry benchmark, it may indicate that your labour resource is spread too thin and there is capacity to take on an additional staff member. Alternatively, it could indicate that the owners of the business are doing a lot of work and not being appropriately remunerated.

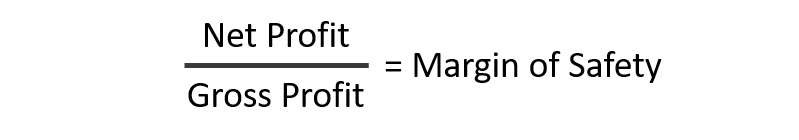

Margin of Safety:

The margin of safety ratio helps demonstrate how much of a fall in sales the business is able to withstand until it starts to incur losses. It may be beneficial to run this scenario if your business is seasonal or if you anticipate difficult trading conditions. Basically, understanding your Margin of Safety uncovers the threshold your business can reach before serious adjustments must be made in order to survive.

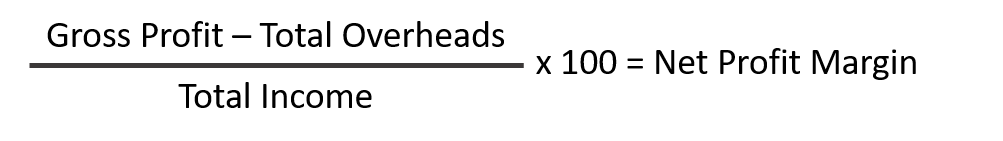

Net Profit Margin:

This ratio is a measure of profitability of the business as a percentage of total revenue, and typically excludes the owner’s remuneration. It is particularly useful if you are investing in a business that is operating under management and you are looking to determine what you could potentially earn from the business, and subsequently its return on investment (ROI).

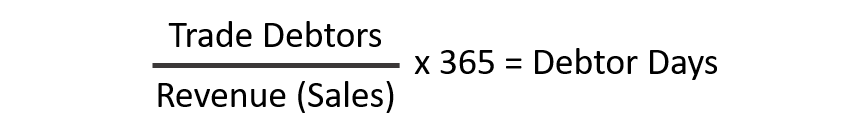

Debtor Days:

The debtor days ratio measures how long it takes on average for your income to be collected from debtors. This ratio is extremely important when you extend credit (i.e invoices) to customers because if the debtor days exceeds the industry terms (or your own debtor terms for that matter) it may result in cash flow problems in the future if not rectified.

Benchmarking – In Practice

What if you were to take on an additional employee – how much of a financial impact does it have on the business’ bottom line, and how much revenue do they need to generate to cover the cost? What if you need to purchase a piece of machinery – can the business afford to pay for it in cash, or alternatively, what does the outbound cash flow look like if you were to finance it? There are many other common business scenarios which can be accurately projected using benchmarking data, the results of which promote effective decision making and foster business growth.

The Bottom Line

At McKinley Plowman, we have access to various industry-specific financial information and benchmarks as well as the expertise to prepare forecasts to assist in guiding you towards your business and financial goals. Our proactive insights and expertise has helped countless clients outperform industry averages and achieve sustainable business growth. To see how your business ‘stacks up’, call us today on 08 9325 2411 (Perth), 08 9301 2200 (Joondalup); alternatively you can contact us via our website.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today