partners for life

A Guide to Refinancing Your Home Loan

Over the years, our circumstances change – it could be a new job, the arrival of children, new financial goals, even a global pandemic! As we move through life, it stands to reason that our home loans should work for whatever our present circumstances entail. On average, Australians change their home loan every 4-5 years through refinancing, despite the majority of loans having 30-year terms. There are many potential upsides to refinancing your home loan, some things to consider, and your options & next steps. Let’s get into it…

Refinancing Your Home Loan – Potential Benefits

We’ll kick off with the reasons why people refinance their home loan, chief among which is the possibility of a better deal – lower fees, interest rates, and repayments. Securing any and all of those means more money in your pocket to spend on other things, or potentially even pay off your loan sooner if you put those unlocked savings back into additional repayments. Other carrots for homeowners to consider refinancing include the availability of an offset account, flexible payment options, redraw facilities, and splitting a loan between fixed and variable rates.

Homeowners may also refinance their home loan in order to unlock funds to renovate. Those who have owned their home for a while and seen its value increase (which could be quite likely given the state of the property market right now, particularly here in WA) may have sufficient equity to fund some home improvements. Furthermore, good renovations can further increase the value of your home and improve your equity position even further.

Refinancing Your Home Loan – Additional Considerations

While there are many lifestyle and flexibility considerations that factor into the decision to refinance your home loan, there is also solid data reinforcing the importance of reviewing your home loan to ensure your minimum repayments are as competitive as they can be. A report by the Australian Competition and Consumer Commission (ACCC) released in December 2020 concluded that people with older home loans were potentially paying thousands more in interest each year than new customers. This is due in part to falling interest rates, as well as the fact that new customers can often secure variable loans at lower rates than existing customers (given the prevalence of banks offering attractive introductory rates to secure new business).

According to the report, the data for which was compiled in September 2020, owner-occupiers signing new variable-rate loans were paying, on average, 2.62%, and this figure now sits around 1.99% as of March 2022. Meanwhile, owner-occupiers with a variable rate loan between 3 and 5 years old were paying an average of 3.20%; loans 5 to 10 years old paid an average of 3.33%; and loans older than 10 years paid an average of 3.66%. As you can see – the older the loan, the higher the interest payments.

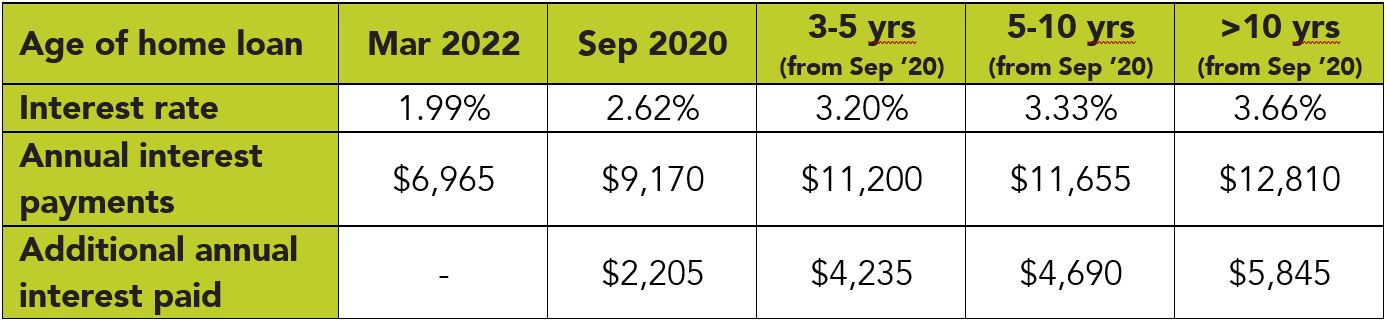

The table below outlines the difference in interest payments across loans of various ages, based on a loan amount of $350,000. Note the interest rates and age of loans are per the figures above, which relate to data collected in September 2020. For further reference, we have included a more recent interest rate, specifically a 1.99% variable rate currently being offered by some lenders.

Difference in Home Loan Interest Payments Based on Age of Loan

Data from: ACCC Final Report: Home Loan Price Inquiry, December 2020

As you can see, there are significant savings associated with refinancing, provided you are able to secure a more competitive interest rate. The level of competition in the market right now, along with historically low interest rates, means that there’s no time like the present to review your loans and explore your options.

Refinancing Your Home Loan – Your Options

Back in the day, the accepted “wisdom” may have been that to get the best deal, you should walk into the bank and demand the rate or product that you want. Homeowners certainly retain the right to go straight to a bank, and for some this may be their preferred option. However, in order to get the best possible deal for your circumstances, engaging with a broker is the way to go. Our extensive and up-to-date industry knowledge allows us to find a product that is suitable for your current situation, and gives you the flexibility you require. Furthermore, the legwork we do to get you into the right loan comes at no cost to you – a bit of a no-brainer!

Next Steps

Considering the potential savings, and the likelihood of at least one official rate rise in 2022, we urge all homeowners to explore refinancing their home loan, and we’re confident that the longer you’ve had your loan, the higher the chances are that we will find you a better deal. So, if you’re ready to reduce your minimum repayments, unlock equity to renovate, pay off your loan faster, or simply explore your options, give the MP+ Finance team a call today on 08 9301 2200 or contact us via our website.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today