partners for life

WA Property Market Update October 2022

Welcome to the October 2022 edition of our WA Property Market Update. This month, it’s a familiar theme – interest rates are up again, the market appears to be cooling slightly, and the general economic and property outlook is uncertain at this stage. What is noteworthy, however, is the fact that the Reserve Bank of Australia (RBA) decided to raise the cash rate by only 0.25 per cent in early October, as opposed to the 0.50 per cent that was anticipated. The impact of this might be minimal, but it will still be welcome news to homeowners and investors alike.

WA Residential Property Market Update October 2022

As we reach the end of October 2022, confidence in the WA residential property market appears to be waning. Thanks in part to rising interest rates, the things are cooling off after a couple of years (especially through COVID) of significant growth in values when looking at Perth as a whole.

However, some of Perth’s suburbs have seen very strong growth in the past 12 months, well over and above the average. For instance, a few northern suburbs have seen growth of between 10 and 40 per cent, and some southern suburbs have grown by between 9 and 15 per cent. Even further up that particular ladder is Fremantle, with a massive 25 per cent increase in value over the past year, and Mount Hawthorn, with 34.4 per cent in the same period. So, despite the market looking like it’s slowing in growth overall, there are pockets that have overperformed.

Looking further afield to country WA, our robust resources sector has brought more people to mining towns such as Kalgoorlie-Boulder, Newman, Karratha, and Port Hedland. High demand for rental properties has meant that returns of over 10% are not uncommon, presenting an attractive opportunity for investors. The sticking point may be interest rates once again, as seasoned and prospective investors alike must ensure that their investments are bearing fruit. With that in mind, partnering with a broker to find the best deal, including refinancing existing loans, is a must.

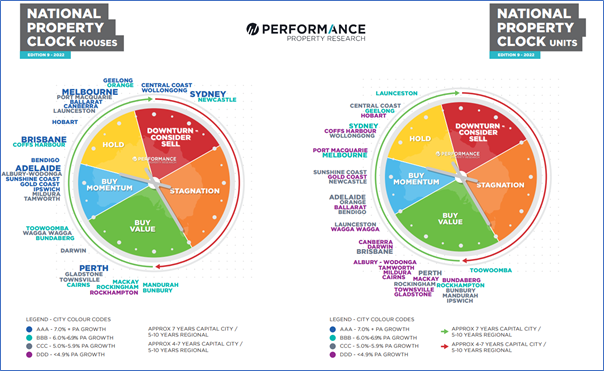

National Property Clock October 2022

WA Industrial Property Market Update October 2022

Throughout 2022, leasing demand for industrial premises across Perth was strong, especially for more modern, high-spec stock. However, due to construction delays that also impacted the residential sector, these newer assets were in relatively low supply. As a result, interest in older-style stock increased, with some locations that had been vacant for a prolonged period finding tenants. Eastern states-based investors are still active and interested in the WA market, which is a good sign that there is value to be found. Rising interest rates may still cause further headaches in the industrial sector as investors weigh up their impact vs. potential rental yields. However, tenant demand suggests that those investing in industrial premises and other commercial assets can still make the venture feasible.

Looking Ahead

As the market cools off from a period of sustained growth, and interest rates rise, it is critical that you are getting the best home loan deal for your circumstances and goals. No matter what stage you’re at – first home purchase, investing, refinancing, downsizing, or anything in between – having an experienced broker in your corner can make a world of difference. Please don’t hesitate to reach out to the Finance team at McKinley Plowman on 08 9301 2200, or contact us via our website, to see how we can assist you.

Data From:

HTW Month in Review October 2022

Performance Property Group – National Property Clock

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today