partners for life

Urgent: Have You Applied for Your Director ID Yet?

Back in 2021, we covered in an article the rollout of Director IDs by the Australian Business Registry Services (ABRS) – a measure intended to combat fraud and security issues in Australian businesses. Now we’re in 2024, the ABRS continues to engage with directors of companies that haven’t yet met their obligations – meaning if you should have registered for your Director ID by now, there’s a very good chance they’ll be in touch with you soon. Here’s a look at the current correspondence initiative, and the potential penalties for non-compliance.

What is a Director ID?

To recap, a Director Identification Number (Director ID) is a personal, unique identifier that Australian directors must apply for once and retain for life. It aims to enhance the integrity of the corporate system by preventing the use of false or fraudulent director identities.

The requirement applies to all directors associated with a company, registered Australian body, registered foreign company, or Aboriginal and Torres Strait Islander corporation. Unlike other company-specific obligations, a Director ID is unique to the individual, meaning you don’t need a separate ID for each company you govern.

The ABRS’s Correspondence Initiative

Note the deadlines given in 2021 for securing a Director ID were as follows:

- Directors appointed prior to 1 November 2021 have until 30 November 2022 to apply for their director ID.

- Any new Directors appointed between 1 November 2021 and 4 April 2022 are required to apply for their director ID within 28 Days of appointment.

- Any new Directors appointed after 5 April 2022 are required to have their director ID before being appointed.

Despite a substantial amount of time given for company directors to arrange their ID, the ABRS has found many yet to meet their obligations – hence their current drive to get everyone registered. Non-compliance isn’t taken lightly – neglecting this duty is a criminal offence, and significant penalties underscore the seriousness of this obligation. The urgency is clear: if you’re poised to become a director, secure your Director ID before your appointment. Existing directors already in position must act immediately.

What Happens if I Don’t Have a Director ID?

The ABRS is proactive in engaging with directors who lag in meeting their Director ID obligations. Directors who haven’t yet applied may face measures such as interviews with the Registrar’s delegate or, more severely, referral to ASIC for potential investigation and prosecution. The penalties for non-compliance, including fines and potential imprisonment, emphasise the critical nature of timely application.

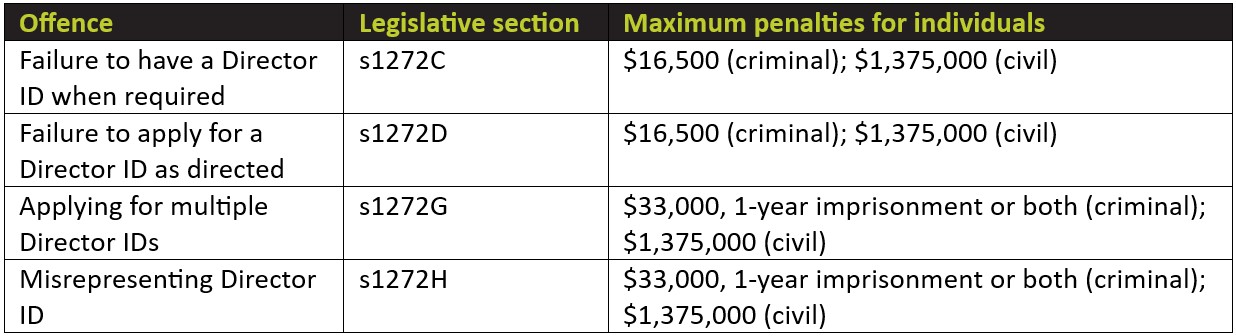

The ABRS aims to assist directors in fulfilling their responsibilities by offering support and guidance. Yet, it’s crucial to be aware of the offenses and penalties that underscore the gravity of these obligations:

What Should I Do Now?

Directors should personally apply for their Director ID, via the online platform at ABRS.gov.au or, alternatively, through phone support at 13 62 50. Remember that this process must be completed by yourself as a director and cannot be delegated (including to McKinley Plowman or other tax agents), due to the identity verification requirements of MyGovID.

While we are not able to do this on your behalf, should you have any questions about your obligations as a director, or how Director IDs may impact your business, please do not hesitate to reach out to the team at McKinley Plowman on 08 9301 2200 (Joondalup), 08 9325 2411 (Perth), or via our website.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today