partners for life

Understanding Stage 3 Tax Cuts

You’ve doubtless heard the term “Stage 3 Tax Cuts” in the headlines recently, but what’s it all about? The Australian Government is set to implement significant changes to the tax system with Stage 3 Tax Cuts, initially legislated a few years ago under the Morrison government. The federal cabinet has recently approved adjustments to this plan, which aim to benefit a broader range of taxpayers, particularly those earning less than $150,000 annually. The impact of the cuts will be different across the whole earning population, the extent of which depends upon an individual’s taxable income. Let’s explore the Stage 3 Tax Cuts and what you can expect, provided the relevant legislation is passed.

What are the Stage 3 Tax Cuts?

The key elements of the updated tax plan include:

- Reinstatement of the 37% Tax Bracket: The plan reintroduces the 37% tax bracket, which was previously set to be removed, affecting income earners in specific brackets.

- Reduction in Tax Rates for Lower Brackets: The bottom tax bracket will enjoy a reduced rate of 16%, alleviating the tax burden on lower-income earners.

- Adjustment of Top Tax Rate Threshold: The threshold for the top tax rate will be lowered to $190,000, impacting high-income earners.

The changes, requiring parliamentary approval, are designed to provide tax relief to Australians, particularly benefiting those earning between $45,000 and $130,000, according to modelling.

How will Stage 3 Tax Cuts Impact my Tax Position?

The Stage 3 Tax Cuts signify a shift in Australia’s tax landscape, affecting taxpayers across various income brackets:

- Low to Middle-Income Earners: Those earning less than $45,000, who were initially excluded in the Morrison Government’s original Stage 3 Tax Cuts, will now benefit.

- Middle-income earners, especially those with annual incomes between $45,000 and $136,000, are projected to experience the most significant tax relief.

- High-Income Earners: Individuals earning above $150,000 will still receive tax cuts, but the benefit will be comparatively smaller than under the original plan.

The tax cut schedule is set to be effective from July 1, 2024. Unlike previous lump-sum tax offsets like the “LMITO,” these tax cuts will reflect in reduced tax withholdings from regular pay checks, providing immediate financial relief. However, the actualization of these changes hinges on the government’s ability to pass the legislation with support from the Greens and other crossbench members.

The Albanese Government has previously stated they have no plans to alter rules concerning negative gearing for property investors – which at this stage still remains the case. However, given the changes they’ve made to these tax cuts, watch this space!

Tax Savings Under the Stage 3 Tax Cuts

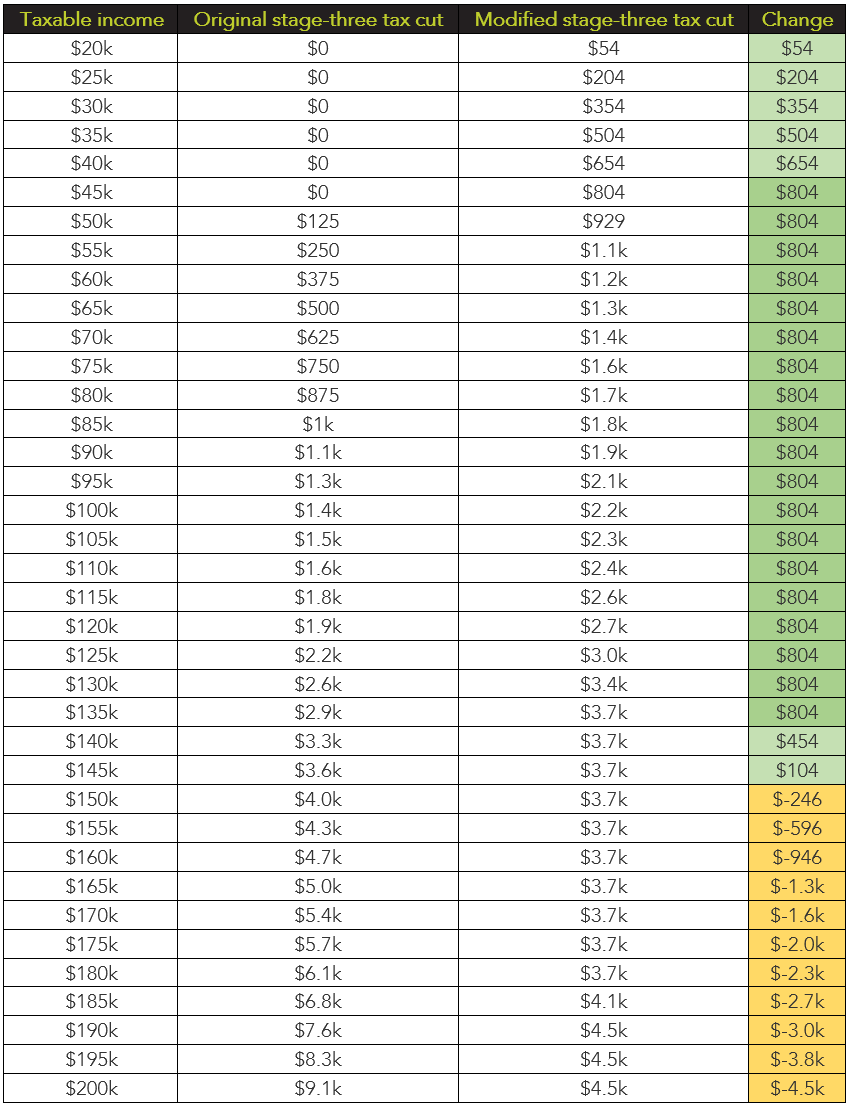

Here’s a quick glance at how the Stage 3 Tax Cuts will bring savings to you, depending upon your taxable income. As you can see, the changes have a significant impact at the higher end, with those earning over $165k in particular likely to be disappointed with the reworked cuts.

New Tax Brackets

The proposed tax brackets under the revised cuts are as follows:

- Income up to $18,200: No tax

- $18,201 – $45,000: 16%

- $45,001 – $135,000: 30%

- $135,001 – $190,000: 37%

- Above $190,000: 45%

Compared to the previous plan, these changes represent a significant restructuring, aimed at making the tax system more progressive and equitable.

Looking Ahead

Considering the Government has already changed its mind once on this issue, it is pertinent to remember that until you see the tax savings in your payslip, don’t take it for granted. The changes are also subject to the passage of relevant legislation, so that too will need to be squared away before we can enjoy the tax savings.

We may have only just started the calendar year, but many Australians are already preparing for tax time – it’ll be here before we know it! Given these changes to tax brackets and your take-home pay, you may have questions about how this new legislation may affect you personally. If that’s the case, please don’t hesitate to reach out to the tax team at McKinley Plowman, on 08 9325 2411 (Perth), 08 9301 2200 (Joondalup), or via our website.

Further reading: Amending tax cuts to deliver broader cost-of-living relief (treasury.gov.au)

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today