partners for life

Reverse Mortgage – Your Key to a More Comfortable Retirement?

For many Australians, the motivation to work hard and accumulate wealth is to eventually transition to a comfortable retirement. Research indicates that Australian Seniors are ranked number 1 in the world in terms of per capita net worth, however 35% are living below the poverty line. In fact, that same population group are second-worst amongst OECD nations in terms of seniors poverty. Part of the problem is that many Aussie seniors are asset-rich, but cash-poor. A reverse mortgage can offer a solution to this problem.

What is a Reverse Mortgage?

A reverse mortgage is the release of equity within a home in the form of a lump sum or income stream payment to a homeowner in retirement. Equity is the value of your home, less the money owed on it (mortgage). Put simply, a reverse mortgage lets you borrow money using the equity in your home as security, and spend it on things like renovations, medical care, living expenses, a holiday, or whatever else you choose.

Why Should Retirees Consider a Reverse Mortgage?

If you’ve seen data from the Australian Bureau of Statistics (ABS) concerning population projections, you’ll be aware that in a few years, Australia will have over 7 million retirees within the total population. What’s more, the percentage of Australians considered “working age” (15 to 64 years) is predicted to decrease from 66% as of 2017 to between 61 and 62% by 2066. This has raised concerns about the sustainability of the Age Pension. Furthermore, advances in medicine and healthcare have increased the average life expectancy in Australia, meaning more people are likely to outlive their nest egg of superannuation and savings.

This data highlights the importance of different options for income in retirement, and having something in place to be able to enjoy the wealth built up in property that is often hard to realise without selling the property itself. Not only is there great financial incentive to look into a reverse mortgage, but the ability also to remain in your own home means you don’t have to leave behind all of your great memories, you can remain within the community with which you’re familiar and comfortable, and there’s no need to tackle the stress of moving house.

Who Can Access a Reverse Mortgage Facility?

Typically, in order to access a reverse mortgage facility, you need to be aged 60 or over, and you must own your home to use it as security on the loan (or intend to pay off the reminder of your mortgage with part of the loan). The amount that you can borrow with a reverse mortgage depends on your age. At age 60, typically the most you can borrow is 15% of your home’s value. This increases by one percent each year, until the age of 90 and above where you can borrow up to 45% of the value of your home.

Impact on the Age Pension

Multiple income streams can, quite rightly, raise questions about how they impact the Age Pension. Ultimately, its impact will depend on individual circumstances, and the purpose of the funds being released through a reverse mortgage. The three ways that the funds can be taken have slightly different considerations.

1. Lump sum:

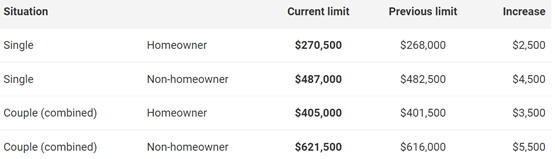

If you take money from a reverse mortgage facility and use it to buy an asset that is assessable by Centrelink (e.g. a car), its value would count towards the asset test of the Age Pension. It combines with any other assessable assets you have (not including the value of your home) and may push you over certain a threshold that would reduce your pension. Current asset limits as of May 2022 for the full Age Pension are as follows:

Table from SuperGuide Australia

Also consider the following:

- Under current Centrelink rules, up to $40,000 of a lump sum drawn down from a reverse mortgage is exempt from the asset test for 90 days – so it would have to be spent within that time to ensure it is not classed as an assessable asset.

- Money drawn down is subject to deeming until it is spent, so depending on how much you draw down and how long it sits in your bank account, deeming rates may impact your eligibility for a full Age Pension.

- If you use a reverse mortgage lump sum payment to purchase an asset that produces income (e.g. shares), income you derive from that asset will be assessed as part of the Age Pension income test.

- If you spend the lump sum on a non-assessable asset, like a holiday, then the amount will not be assessed under the income or assets test.

2. Income Stream:

If you take your reverse mortgage payments as a regular income stream and spend it on living expenses or non-assessable assets, then it should not affect your pension. This is because it is not considered “income” by the income test, and assuming you spend it promptly (rather than letting it sit in your bank account) it should not fall under the assets test either.

3. Money in Reserve:

If you have funds available to you as part of your reverse mortgage, but haven’t yet drawn those funds down, they are not assessable under either the income or assets tests, and therefore should not impact your pension.

What Now?

Reverse Mortgages are not a one-size-fits-all solution; however, it is prudent to consider them within a broader retirement planning strategy. If retirement is on the cards for you, even if it seems like it might be several years down the track, consider speaking to McKinley Plowman. Our Finance and Wealth teams can work together to find a solution that suits your current financial position and retirement goals, ultimately giving you the income required to retire in the comfort you desire.

You can reach us on 08 9301 2200 or via our website. While you’re there, you might also like to try our free reverse mortgage calculator.

General advice warning: The advice provided is general advice only as, in preparing it we did not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of this advice, you should consider how appropriate the advice is to your particular investment needs, and objectives. You should also consider the relevant Product Disclosure Statement before making any decision relating to a financial product.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today