partners for life

JobKeeper 2.0 – The Next Chapter

**Updated following announcement on 6 August 2020**

The original JobKeeper payment was announced by the Federal Government in late March 2020 in response to COVID-19 and comprised a $1500 per fortnight wage subsidy for businesses so they could continue to pay eligible workers. For the most part, this payment helped keep people employed and their heads above water, and around 920,000 organisations and approximately 3.5 million individuals have benefited from the scheme so far. This reflects 30% of employment in the private sector before the pandemic.

Much has been made of the Government’s plans to end the JobKeeper program at the end of September, with many concerned that businesses and workers will struggle should it not be extended. On 21 July 2020, an announcement was made by the Government outlining its plans to extend the JobKeeper program to 28 March 2021, with reduced payment rates and employee access in force from 28 September 2020. Then on 6 August 2020, further changes to JobKeeper 2.0 were announced, and those have been included in the post below.

So – what will JobKeeper 2.0 mean for your business or your job?

JobKeeper 2.0 – Employers

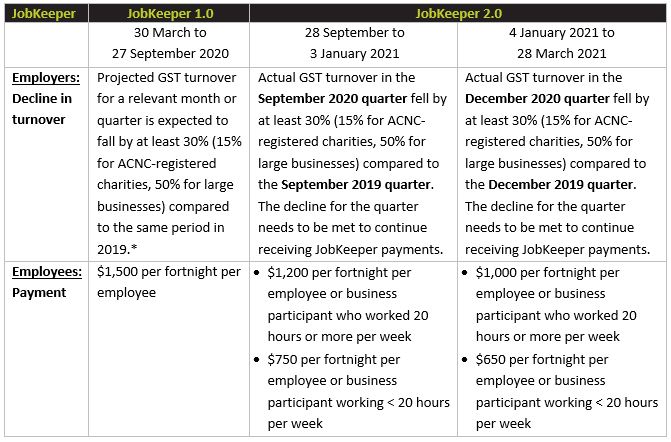

For the second iteration of the JobKeeper scheme, the eligibility test for employers, as well as the amount paid to employees, has changed. In order to continue to receive JobKeeper payments for eligible employees beyond 28 September 2020, businesses will need to reassess their eligibility against by comparing aggregated actual GST turnover figures for the relevant periods (more details in the table under the heading “Summary – JobKeeper 1.0 to 2.0” below). This means:

- For payments from 28 September 2020 to 3 January 2021, turnover must be assessed for the September 2020 quarter against the September quarter from 2019; and

- For payments from 4 January 2021 to 28 March 2021, turnover must be assessed for the December 2020 quarter against the December 2019 quarter.

For illustrative purposes, the following is a practical example of how the new eligibility rules are applied:

Jane’s Jewellery Store:

- JobKeeper Payments 28 September 2020 – 3 January 2021

- In order to assess her eligibility for above payment period, Jane compares her turnover for September quarter 2020 with September quarter 2019 and finds a reduction of 33%.

- The business will be eligible for JobKeeper 2.0 payments for the period 28 September 2020 – 3 January 2021 because each the quarter satisfies the 30% decline in turnover test.

- JobKeeper Payments 4 January 2021 – 28 March 2021

- In January 2021, Jane has the data she requires to assess her eligibility for the second phase of the JobKeeper 2.0 payment period, 4 January 2021 – 28 March 2021.

- She compares her turnover for the December quarter 2020 with the December quarter 2019 and finds her turnover only reduced by 10%.

- As such, Jane’s turnover reduction now falls short of the required 30% reduction for the December quarter, and her Jewellery Store will not be eligible for the JobKeeper 2.0 payments from 4 January 2021 – 28 March 2021. This is despite satisfying the turnover decline for the previous quarters.

Business Activity Statement (BAS) reporting will be the most common port of call for businesses to assess any reduction in turnover and other eligibility factors. That said, BAS deadlines usually don’t fall until the month following the end of the quarter, so businesses will be required to assess their eligibility for JobKeeper 2.0 ahead of the normal BAS deadline. Note that the ATO can use its discretion to extend the time that a business has to pay employees in order to meet the wage condition.

JobKeeper 2.0 – Employees

Upon the introduction of JobKeeper 2.0 at the end of September, the amount paid out to employees through the JobKeeper program will be reduced, and must have been employed as of 1 July 2020 as a full-time, part-time or fixed-term employee (or were a long-term casual as of 1 July 2020). This is extended forward from the original required start date of 1 March 2020 (or the requirement to have been long-term casual for 1 year up to 1 March 2020).

The new lower JobKeeper payments starting from 28 September 2020 will be based on hours per week worked, on average, in the four weeks of pay periods up to 1 March 2020 or 1 July 2020. The rate of payment will differ between those who usually work less than 20 hours per week and those who work 20 or more hours per week. Check the table below for details on the differences in payments. In situations where the hours worked by an employee or eligible business participant were not “usual” during February 2020, alternative tests may be made available by the ATO at a later date. Guidance is also yet to be provided regarding non-weekly pay periods, as well as the application of alternative tests under JobKeeper 2.0.

Summary – JobKeeper 1.0 to 2.0

A summary of the changes to the JobKeeper scheme, between 1.0 and 2.0, are as follows:

* Alternative tests potentially apply where a business fails the basic test and does not have a relevant comparison period.

Final Words

It is worth remembering that if your business and workers have been accessing JobKeeper through the original tests, and wage requirements have been fulfilled up to this point, you will still be able to claim JobKeeper payments until the changes are brought into effect for the fortnight starting 28 September 2020. Now that there is some clarity on the tests and criteria around JobKeeper 2.0, now is the time to start planning for the changeover.

The details in this article are correct as of 7 August 2020, and MP+ will continue to provide updates as they come to light.

If we have assisted you with the original registration and reporting requirements for JobKeeper 1.0, we will continue to do so through the changes as well. If you haven’t yet engaged our services to guide you through JobKeeper but would now like our assistance, we’re happy to help. Don’t hesitate to get in touch with McKinley Plowman today on 08 9301 2200 or visit www.mckinleyplowman.com.au.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today