partners for life

Amended Rules and Higher Thresholds for HELP

If you’re a beneficiary of the Higher Education Loan Program (HELP) you already know that once you start working and reach a certain income from your job, you are to repay the program through tax payments. As you earn more, your repayments will also be higher.

Note that the value of your repayment will take into consideration the fringe benefits and the above compulsory amount of super contribution from your employer that are all reflected in your payslip.

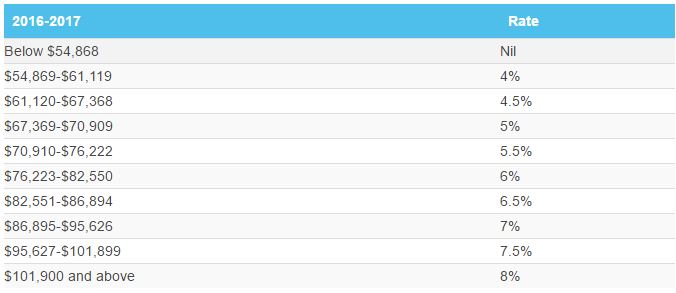

For the income year 2016-2017, the repayment rates were revised and were increased due to the movements in average weekly earnings.

Based on the reviewed thresholds, these are the compulsory repayment rates for HELP for the present income year (2016-2017):

Upfront Discount Cancelled

Another amendment to the program is that from 1 January 2017, the HECS-HELP upfront 10% discount, as well as the voluntary HELP repayment bonus of 5% that are given to eligible students, will be discontinued.

Requirements When Travelling Abroad

If you are planning to take a sabbatical abroad, you are now obliged to report to the Tax Office a week prior to leaving the country; should you be travelling abroad for more than 183 days. The ATO will be requiring you to submit details such as contact numbers, international address, and email address.

Remember to advise your accountant of any HELP debts, contact us for more information or to answer any questions you may have.

.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today