partners for life

Market Volatility Update – June 2022

As you would have witnessed over the recent period, investment markets have been extremely volatile. We wanted to take the opportunity to provide you with some context and emphasise the importance of reflecting on investment fundamentals during such challenging times.

In this regard, we wish to provide several important insights on prevailing macroeconomic conditions and their effect on financial markets, and the impact this can have on your investments.

Why are Global Markets Volatile Right Now?

Stock markets have fallen globally and continue to be volatile. The uncertainty within them is due to a few factors, chief among which is inflation. Inflation is currently running much higher than central bank long-term targets as a result of COVID-related lockdowns, quantitative easing, and the ongoing war in Ukraine which is impacting global energy and food prices. To combat this, central banks around the world are raising interest rates, impacting the ability of economies and companies to grow. In turn, this creates pessimism in the market and a risk of global recession. Markets have recently been spooked by the alarming rate at which interest rates are rising, and the expectation of future rises, thus a significant sell off in global stock markets was seen this week.

Market Volatility: Impact on Bonds

The dramatic increase in interest rates has also impacted bond prices. As the yield, or interest rate payable, increases on a bond, the price reduces – resulting in a fall in bond values over the past few months. Bonds are inherently defensive investments and remain a staple of a conservative portfolio, given you are essentially investing in an investment that returns all of your capital plus interest if held to maturity. The flow on effect from rising yields is that there should be higher levels of income payable from bond investments in the future which will help to recoup some of the losses seen as prices fell.

Maintaining a Long-Term Perspective

“Time is your friend, impulse is your enemy” – John Bogle

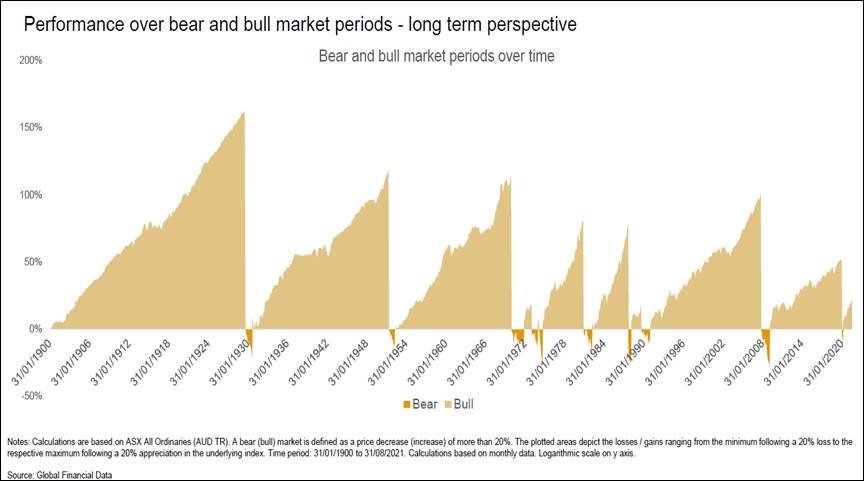

During volatile times like this, where uncertainty is rife and everyone has an opinion, it is critical to remain rational and maintain a longer-term perspective. The vast majority of investors are invested for long periods of time and it is normal for markets to move in cycles and experience short-term volatility, particularly in growth assets. Staying invested and riding the bumpy roads when they come along is part of the investment journey. Historically speaking, ‘bear markets’ (falls of more than 20%) last significantly less time than subsequent rising ‘bull markets’. See the graph below for more information.

Bear and Bull Market Periods – Long Term Perspective

Having the experience of a dedicated Wealth professional on your side, like the team at McKinley Plowman, means that you can be confident in your investment strategy. Every day, our team places investment trades, rebalances portfolios and processes withdrawals for our clients, using our skills and experience to act in their best interests. This often includes averaging tactics and specific drawdown strategies to mitigate risk. These strategies are managed in conjunction with our dedicated third party researcher houses and institutional investment managers.

Understanding Short-Term Reactions to Market Volatility

It is completely understandable that in times like this the natural reflex for an investor may be to cash out when the news is bad. Unfortunately, many people who do this incur transaction costs, potential tax and only buy back in when the economic sunshine has returned, potentially missing out on most of the recovering upswing in markets.

It’s generally misunderstood but important to recognise that markets are often forward looking and when there is fear over the future health of the economy, substantially higher interest rates or even a global recession, this has often already been priced into the market. Further, a recent survey of professional investors indicate high levels of pessimism in markets. Similarly pessimistic readings in 2015, 2016, 2018, and 2020 occurred near market bottoms and therefore it is more important than ever to remain rational and not lose focus on your longer-term objectives.

(Source: Refinitiv DataStream – 7 June 2022)

We’re Here if You Need Us

An important part of our ongoing advice relationship is our formal annual advice meeting. We also need to check in with each other when circumstances, legislation or economic conditions change. When times are uncertain, good communication is the key – so if you are concerned about the current market volatility and how it impacts your portfolio, please reach out to us and we will be happy to talk or meet with you to discuss.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today