partners for life

Financial Advisers: Your Partners in Wealth (Part Two – A “Money Mentor”)

In today’s volatile markets, advisers play a crucial role in helping clients navigate not only the technical aspects of finance but also the emotional rollercoaster of investing, filling the role of a “money mentor”. Unexpected events, such as the global COVID-19 pandemic, the Ukraine crisis, the US banking debacle, and surging interest rates, have repeatedly tested investors’ nerves as market volatility temporarily impacted portfolio values. However, savvy investors who have an ongoing relationship with their financial adviser are better able to find their way through these tougher times and block out the media noise. Let’s explore how an adviser provides not only technical financial expertise, but a cool head and guiding hand to make the most of your investment journey.

Advisers Facilitate Sound Decision-Making

Less than two decades ago, the global financial crisis (GFC) shook markets, leaving a lasting impression on many. Advisers, however, have been instrumental in teaching their clients that a well-constructed portfolio can weather extreme periods of volatility, as both the GFC and COVID-19 demonstrated. This lesson remains valuable even as official interest rates have risen from emergency lows to 11-year highs. Investors are learning that high inflation erodes returns from cash investments, leading to lower real returns.

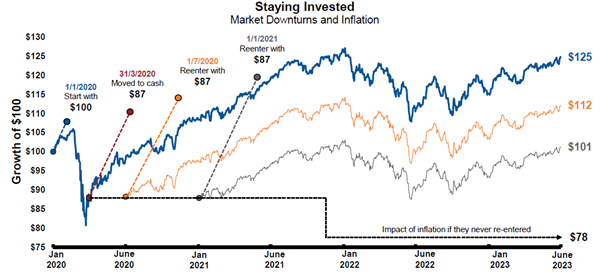

Consider the journey of four hypothetical investors who each invested $100 in January 2020 but reacted differently to the market downturn triggered by COVID-19 in March that year:

- Olivia (Blue Line) stuck with her investments, and her $100 turned into $125 by June 2023.

- Amir (Orange Line) panicked and put his $100 into cash, but then he got back into investing three months later. His money grew to $112.

- Sofia (Grey Line) also put her $100 into cash but waited until the next year to start investing again. She ended up with $101.

- Ethan (Black Line) put his money into cash and never went back into investing. Now, his $87 is worth even less because of inflation, just $78.

Staying Invested – Market Downturns and Inflation

Missing even a handful of the market’s best days can significantly affect the capital you accumulate over time. Markets, while unpredictable in the short term, have historically risen over the long term. Investors who stayed invested in the S&P/ASX300 Total Return Index over the past decade amassed significantly more wealth than those who missed even the 10 best days of performance. Missing the best 20 days left investors more than 50% worse off than if they had stayed invested throughout the entire decade. In another example, calculations suggest that regularly adjusting exposure to the US S&P500 Index may have cost investors as much as 3.39% in returns over the 20 years leading up to June 2023.

Without the guidance of a money mentor, you can easily fall into the trap of buying when markets are bullish and selling when sentiment turns bearish. Advisers play a vital role in helping you maintain your long-term strategies in the face of unsettling market volatility, provide stability and prevent impulsive decisions during market turbulence.

Advisers Provide Choices and Trade-offs

The role of advisers extends far beyond selecting investments; it encompasses holistic wealth management. The financial landscape is becoming increasingly complex, with factors like regulation, family dynamics, and social security playing critical roles. These factors evolve as you age and transition through life’s various stages.

Over the next 40 years, the number of Australians aged 65 and over is projected to more than double, with those aged at least 85 expected to more than triple. This demographic shift brings forth a multitude of choices and trade-offs that previous generations did not always encounter. These include scenarios like the “bank of mum and dad” funding mortgage deposits, grandparents financing school fees, second marriages complicating estate planning, the sandwich generation juggling aging parents and children’s needs, older parents providing early inheritances, and older singles considering a range of retirement funding options.

Each of these scenarios may require intricate arrangements to ensure no party is disadvantaged and family relationships remain intact. Advisers play a crucial role in this planning by offering assistance in establishing loan agreements, working alongside lawyers and accountants to devise solutions that protect your interests. Even aside from these specific scenarios, your unique circumstances, preferences, and considerations necessitate countless decisions over a lifetime, hence the value of a money mentor.

External factors can impact wealth strategies as significantly as personal preferences. Particularly in 2023, this is evident in rising interest rates and high inflation, forcing people to reassess their financial situations. Additionally, an aging population poses challenges related to social security for the elderly and inheritance events for younger generations. As you age, your adviser can help you access available benefits, such as the Commonwealth Seniors Health Card, and help those who inherit assets manage and minimise potential tax implications.

Above all, advisers lay out your choices and trade-offs, giving you clarity and a way forward.

Advisers Understand the Human Side

Financial advisers are not merely financial technicians; their role as a money mentor means they also specialise in human behaviour, fostering trusted relationships that enable them to deliver effective recommendations. In both good and challenging times, your adviser’s role is to help you achieve lifelong goals and navigate personal milestones, by providing a blend of technical expertise and emotional support.

Where external pressures impact your investments, or even just your appetite for risk, advisers stay on top of regulatory changes and product innovations, and interpret changes to understand their impact and opportunities for you.

Retirement planning is another area where professional advice is particularly valuable. Legislative changes and product innovations are expanding the decisions that pre-retirees and retirees must make as they age – so depending what life stage you’re at, retirement planning may already be a key consideration. With the impending retirement of the Baby Boomer generation, more people need to establish income streams, make aged care decisions, and engage in comprehensive estate planning. Each of these decisions carries both financial and emotional implications, as individuals transition out of the workforce and plan for their later years. A financial adviser helps you take care of this planning and ensure you can access the entitlements to which you’re eligible (e.g. Age Pension).

Here are some key stats to consider:

- 17% of Australians lack confidence in their ability to achieve financial goals.

- Only 45.3% of Australians have a financial plan for retirement.

- 33% of Australians find dealing with money stressful or overwhelming.

Financial advisers help you with all that and much more.

McKinley Plowman: Your Partners for Life

McKinley Plowman’s advisers and team of experienced support professionals are well-versed in understanding each and every clients’ unique needs and circumstances, and tailoring a financial plan to help them achieve their goals. Our clients enjoy the value of working with an experienced adviser and money mentor, tapping into their experience and knowledge, and partnering with them as lifestyles and needs change.

If you’re ready to see how we can help you achieve clarity and financial independence, please reach out to us today on 08 9325 2411 (Perth), 08 9301 2200 (Joondalup), or via our website.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today