partners for life

EOFY Super Strategies 2024-25

EOFY Super Strategies 2024-25: Boost your Balance & Optimise your Tax Position

As 30 June approaches and the 2024-25 financial year draws to a close, Australians across all stages of life have an opportunity to boost their retirement savings and optimise their tax position with clever EOFY super strategies. Whether you have a Self-Managed Super Fund (SMSF) or contribute to a retail or industry fund, the lead-up to EOFY is an important time to act. From maximising contributions to claiming deductions, the right EOFY Super Strategies can help you reduce tax and strengthen your retirement position. Here’s how you can make the most of the concessions and super mechanisms available to you.

Maximise Concessional Contributions

Concessional (pre-tax) contributions — such as employer super guarantee payments, salary sacrifice amounts, and personal contributions for which you claim a deduction — are taxed at just 15% within your fund. That’s significantly less than most people’s marginal tax rate, making it a powerful way to reduce tax and grow your super.

Important update: From 1 July 2024, the concessional contributions cap increased from $27,500 to $30,000. So before 30 June, you have one last chance to contribute under the current year’s cap. If you’ve had a high-income year, this could be a valuable deduction opportunity. To avoid exceeding your cap, log into your super fund to check how much has already been contributed this financial year.

Use Carry-Forward Concessional Contributions

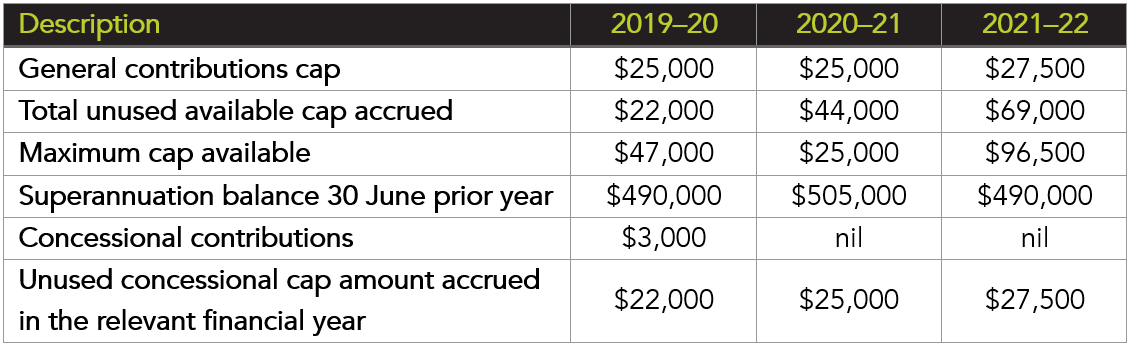

If your total super balance was under $500,000 on 30 June 2024, you may be eligible to carry forward unused concessional contribution caps from the previous five years. This allows you to “catch up” on contributions and potentially claim a larger tax deduction — ideal for those with fluctuating income or irregular contribution patterns.

This year is the final opportunity to use unused cap amounts from 2018–19, which expire on 30 June 2025 as Government rules state that unused cap amounts can only be carried forward for a maximum of 5 years.

Top Up with Non-Concessional Contributions

Non-concessional (after-tax) contributions allow you to add to your super without claiming a tax deduction. These contributions aren’t taxed going into the fund, and can significantly enhance your retirement balance over time, particularly in a tax-effective environment like super. From 1 July 2024, the non-concessional contributions cap will increase from $110,000 to $120,000. You may also be able to contribute up to $360,000 in one year using the bring-forward rule — depending on your total super balance and recent contribution history. This strategy can apply to both SMSFs and retail/industry funds.

Get a Boost from the Government

If you are eligible (based on your income and a few other factors), the government will make a co-contribution of up to $500 to your super balance if you make additional personal contributions. Additionally, if you’re a low income earner (<$37,000 per annum), the Low Income Super Tax Offset (LISTO) scheme gives you a refund of up to $500 on the tax payable on eligible concessional contributions. For more info on government contributions, click here.

Spouse Contributions or Contribution Splitting

If your spouse earns under $40,000 per year, you may be eligible to claim a tax offset of up to $540 for contributions made to their super. This strategy benefits couples who want to balance their retirement savings and improve their collective long-term outcomes. Typically, you can apply to split contributions after the end of the financial year in which contributions are made. Alternatively, contribution splitting allows you to move up to 85% of your concessional contributions to your spouse’s fund. This can be useful for accessing better tax treatment in retirement or managing benefit access ages. These strategies are supported by most super funds, including SMSFs and retail funds.

EOFY Super Strategies: Cut-Off Dates

Timing is everything when it comes to EOFY super strategies. Here are some of the key dates to keep in mind:

- 23 June 2025: Last day to make personal contributions to ensure they are processed before 30 June.

- 20 June 2025: Deadline for FY23/24 contribution split applications.

- 30 June 2025 or the day you lodge your tax return (whichever comes first): Last chance to submit a valid Notice of Intent to claim a tax deduction on personal contributions for the 2023-24 Financial Year.

Clean Up Your Super: EOFY Housekeeping Tips

Whether you’re managing your own SMSF or have a super account with a larger provider, EOFY is a good time to take stock:

- Check that all expected employer contributions have been received.

- Consolidate multiple super accounts to save on fees.

- Review your investment mix and risk profile.

- Make sure your insurance cover is appropriate.

- Update your beneficiary nominations.

- Plan any salary sacrifice arrangements for the new financial year.

Your EOFY Super Strategy

A comprehensive EOFY Super Strategy isn’t just for high-net-worth individuals or business owners — they’re for anyone wanting to maximise super contributions, reduce tax, and grow their retirement nest egg. Whether you’re with a retail fund, industry fund, or have your own SMSF, the team at McKinley Plowman can help you create and implement a tailored strategy. From general super advice to complex SMSF compliance, we’re here to guide you.

Call us today on (08) 9301 2200 or contact us online to make sure you’re ready for 30 June and beyond.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today