partners for life

Commonwealth Seniors Health Card – Eligibility Update

If you or someone you know is approaching, or has reached, retirement age, you may have come across the Commonwealth Seniors Health Card (CSHC). This card gives holders access to benefits that may reduce the burden of medical bills as they grow old, but those with retirement income over a pre-defined threshold are not eligible. However, the Government is looking to pass legislation that will make thousands of Australians eligible for the card, where previously they were not. Read on to find out what the CSHC is, what changes might be brought in soon, and its full eligibility criteria.

What is the Commonwealth Seniors Health Card?

The Commonwealth Seniors Health Card (CSHC) is a concession card that gives its holders access to cheaper health care and other discounts after they’ve reached Age Pension age. Benefits of having a CSHC include cheaper medicine under the Pharmaceutical Benefits Scheme (PBS); bulk-billed doctors visits (depending on the doctor), and a refund for medical costs when you reach the Medicare safety net.

Further to this, seniors may also receive benefits from their state government, depending on the state in which they reside. This could include reduced power and gas bills, property and water rates, ambulance, dental and eye care, and/or public transport fare discounts.

Commonwealth Seniors Health Card – New Income Threshold

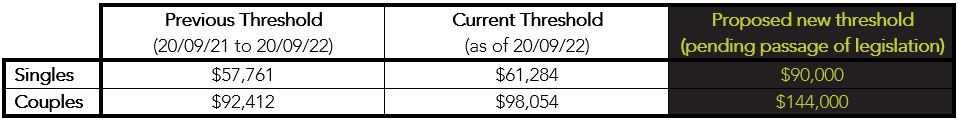

The income test for the CSHC is reviewed every year, and typically increases with the Consumer Price Index (CPI). The current income test, as of 20 September 2022, dictates that to be eligible for the card, you must earn no more than $61,284 for singles; or $98,054 for couples. Currently there is no asset test.

What is being proposed is a significant increase to that threshold. Relevant legislation is currently in Parliament, but should it pass through as expected, it will significantly increase the number of Australians who qualify. Referring to the table below, the proposed new thresholds are as follows (along with current and previous thresholds).

CHSC Income Test Thresholds

As you can see, pending passage of legislation, the proposed changes will bring a significant number of Australians under the new threshold and therefore make them eligible for the card, likely to be a further 44,000.

Full Eligibility Criteria for the Commonwealth Seniors Health Card

In order to obtain a CSHC, you must meet all of the following criteria:

- Be Age Pension age or older (see the criteria for that here)

- You must live in Australia and have Australian Citizenship, a permanent visa, or a special category visa.

- Not be receiving a payment from Service Australia or the Department of Veterans’ Affairs

- Provide a Tax File Number or be exempt from doing so

- Meet the Government’s identity requirements

- Meet the income test (per the information earlier in the article)

How MP+ Can Help

Understanding what you are eligible for when you retire can be tricky. At McKinley Plowman, our Wealth team includes financial advisers who specialise in retirement planning including social security entitlements. They can help you assess your eligibility for the CSHC and determine how its benefits fit into your overall retirement plan. The key to success here is establishing an advice relationship well before retirement – so even if you aren’t planning on moving on from working life just yet, it’s never too early to start planning. If you would like more information on how we can help you maximise your income in retirement, please don’t hesitate to give us a call on 08 9301 2200, or visit our website.

Reference:

BT Top Adviser Questions September 2022

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today