partners for life

WA Property Market Update August 2020

An already-struggling WA property market needed a light at the end of the tunnel, and some optimism about the future – not quite what COVID-19 has brought along! There’s still a long way to go in the WA property market recovery process, and it will likely be some time before we see significant growth in either the residential or commercial markets. As always, there are some opportunities to be found for savvy investors, despite the doom and gloom.

So, what does the WA property market look like, and where are we headed?

Residential Property Market

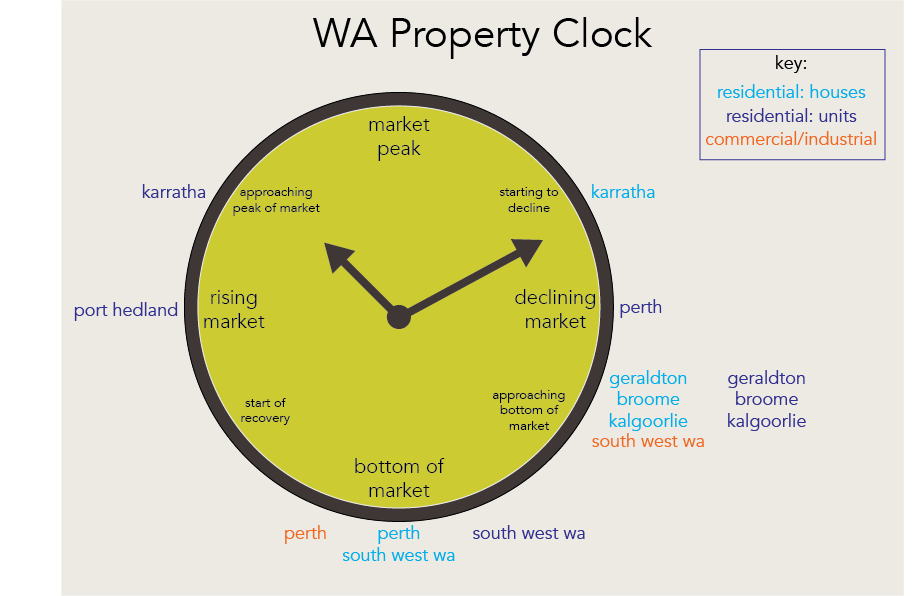

Perth, and indeed other WA regional centres, continue to hover around the bottom of the property cycle as they have done for some time. This presents a challenge for anyone looking to sell but is an awesome opportunity for first home buyers and investors to get into the property game.

The median house price in Perth fell in the June quarter to $475,000 (from $489,000 for the June quarter 2019) with fewer houses listed for sale and fewer available for rent. Research has shown that national investor and consumer sentiment has taken a significant hit as a result of COVID-19 but given WA’s measured and (so far) successful response to the pandemic, this reduction may not be as substantial over here. What is obvious is that the affordability of property around WA combined with generous incentive schemes from the State and Federal Governments means the right property at the right price is still an attractive prospect.

Regional markets like Kalgoorlie-Boulder and Karratha are presenting some impressive rental yields as the mining industry continues to perform well and companies look to move more employees into permanent residency as opposed to Fly-In-Fly-Out work. Vacancy rates in these regional centres are generally lower than in Perth, making some clever investors take notice.

Commercial Property Market

The commercial property market in WA is sitting around the same place in the national property cycle as the residential market. COVID-19 has meant international investment in large-scale commercial and industrial projects in the state is far lower than it would otherwise be, which is disappointing considering the general optimism around the sector pre-pandemic. Since March, local market activity has diminished significantly with a very low volume of investment-based acquisitions so far in 2020.

That being said, the commercial and industrial property markets have been impacted to a lesser extent than retail, hospitality and tourism due to the fact that those areas have been subject to forced shutdowns for a period of time. The growing push towards people shopping online through e-commerce facilities has also impacted the sector, with increased demand for warehouse space and logistics facilities to support the supply chain process.

Industrial investment has come from a variety of sources, including local investors, Self-Managed Super Funds (SMSFs), Real Estate Investment Trusts and syndicates within WA and beyond.

Where on the National Property Clock do WA’s regional centres sit?

Looking Forward

The long-term outlook is a little harder to predict given present global economic circumstances. Whether or not WA’s hard border closure remains in place will also play an important role in the property market, particularly with regards to net immigration figures and how that impacts the demand for real estate. How the Eastern States continue to battle the pandemic will invariably have some impact on WA’s markets, whether directly through the transmission of COVID-19 should the border re-open, or indirectly through supply chain issues.

Residential markets may struggle on for a while longer, but as always, the more positive and astute investors will be able to spot a bargain or two and make the most of a bad situation. Couple that with generous schemes and incentives from the State and Federal Governments (HomeBuilder and the like), and there is certainly a silver lining to be seen. Lower rates from lenders also present an opportunity for existing homeowners to refinance their existing loans, and potentially unlock some equity to take on an investment property.

No matter what stage you’re at or where you fit into the above – buying your first home, refinancing, or looking to invest – the Finance team at McKinley Plowman can help you make the most out of your situation. Call Paul Moran and Paul Tate today on 08 9301 2200 or visit www.mckinleyplowman.com.au/services/finance.

Data from: Herron Todd White Month In Review August 2020

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today