partners for life

Accounting

Forecasting for Business Growth

November 19th, 2025In the business world, knowledge is a powerful asset, particularly when it comes to understanding your financial future. While we can’t rely on a crystal ball for predictions, it is undeniably important to forecast the financial performance of your business. In fact, forecasting should be an integral part of your operational strategy, not something doneread more

Director Penalty Notice (DPN) – Another ATO Compliance Crackdown

September 22nd, 2025The Australian Taxation Office (ATO) is turning up the heat on directors, with the number of Director Penalty Notices (DPNs) surging as small business debt surpasses $100 billion as of March 2025. Enforcement through DPNs is occurring at an unprecedented rate – jumping from 26,702 in FY23–24 to more than 84,000 in FY24–25. For companyread more

Section 100A and More – Trusts Under the ATO’s Microscope

September 17th, 2025Section 100A and More – Trusts Under the ATO’s Microscope - What You Need to Know In recent years, the Australian Taxation Office (ATO) has significantly intensified its focus on family trusts, particularly in the wake of reforms and clarified guidance around section 100A reimbursement agreements. With more stringent compliance expectations, sharper audit activity, andread more

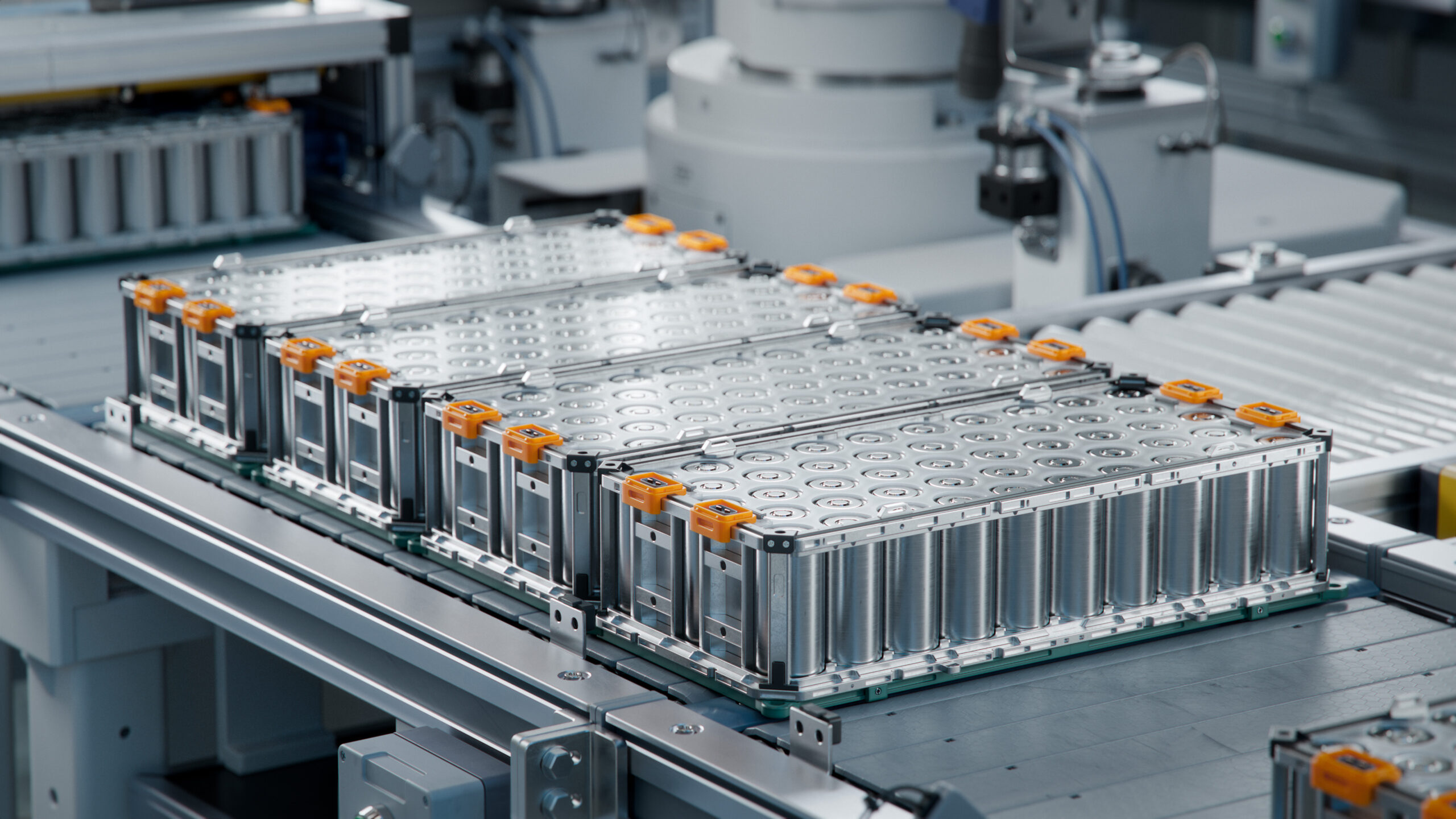

WA Budget 2025: Powering Battery Manufacturing Through Grants and Loans

July 16th, 2025Western Australia is charging ahead with its clean energy transition, and the 2025–26 WA State Budget puts battery manufacturing front and centre with grants and other incentives. With $50 million allocated specifically to support local battery manufacturing, and billions more across the broader renewable energy ecosystem, the Cook Government is giving WA businesses a uniqueread more

2025 End of Financial Year Business Preparation

June 13th, 2025At this time of year, we find ourselves having regular discussions with clients about best business practice for 2025 End of Financial Year preparations. This can include end of year payroll, transitioning to cloud-based software for the first time, changing software providers, or simply reviewing data file accuracy. A proactive approach and mindset are keyread more

How to Grow Your Business – Five Key Focus Areas

May 14th, 2025For the vast majority of business owners, the goal for the first few years is to achieve stability – predictable cashflow, a steady stream of customers and new business, and certainty around the future. Once things have stabilised, some take a breather and rest on their laurels. Others look to take active steps towards buildingread more

MP+ 2025-26 Federal Budget Update

March 26th, 2025The 2025–26 Federal Budget was handed down on Tuesday, 25 March 2025 by Treasurer Jim Chalmers of the Albanese Government. After two consecutive surpluses, this year’s Budget marks a return to deficit, with a forecast shortfall of $42.1 billion for 2025–26. This year marks another Budget with relatively little for businesses, particularly small to mediumread more

Securing Your Legacy with Succession and Estate Planning

February 6th, 2025No matter your family’s asset position, complexity of structures, or business interests – it goes without saying that thorough and effective planning makes a world of difference to day-to-day operations. However, long-term Succession and Estate planning is often given less attention – though it really shouldn’t. Understanding the intricacies of Succession and Estate planning isread more

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today